Unlocking Crypto Yields: A Deep Dive into Passive Income in Web3

Crypto yields have significantly transformed the investment landscape for investors seeking to optimise their assets. As the crypto landscape continues to evolve, yield strategies have grown into a sophisticated ecosystem, offering diverse opportunities for passive income and portfolio diversification. In this post, we explore what crypto yields are, break down the various types of yield, and explain why these mechanisms are capturing the attention of investors around the globe.

What Are Crypto Yields?

Crypto yields refer to the rewards generated from deploying digital assets into various yield-bearing strategies within the crypto ecosystem. Unlike traditional savings accounts, where interest is earned at a set rate, crypto yield strategies harness the dynamic nature of blockchain technology, smart contracts, and decentralized protocols to offer potentially higher returns. This emerging field has seen innovations such as yield farming, staking, liquidity mining, and more, each designed to leverage the power of decentralized networks.

The Rise of Yield Farming and Staking

Yield Farming: Dynamic Returns on Your Digital Assets

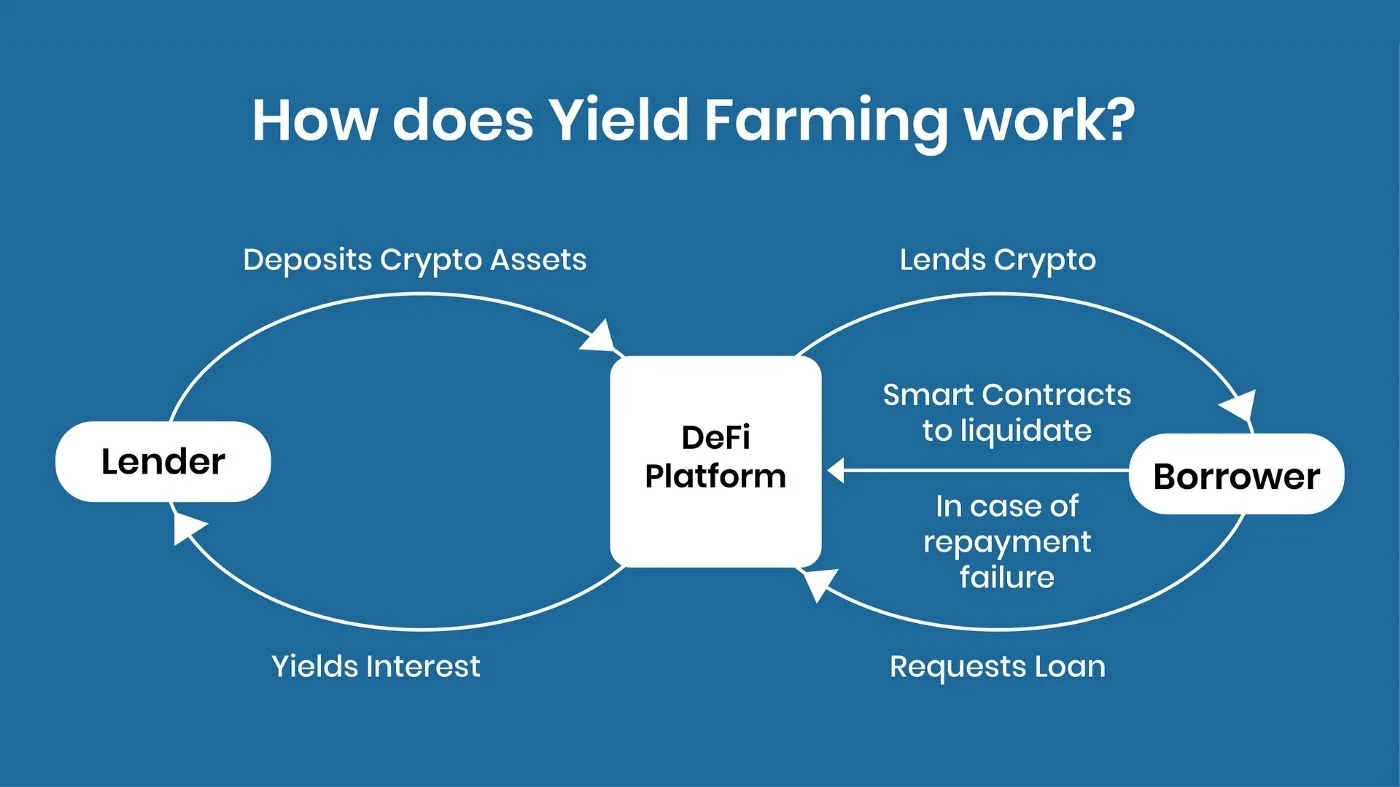

Yield farming involves strategically lending or staking cryptocurrencies across various DeFi protocols to earn rewards. Investors typically move assets between platforms in search of the best yields, creating a competitive environment that continuously drives up interest rates and rewards. The practice requires careful risk assessment and market analysis, as returns can fluctuate based on protocol performance and market demand.

- Key Benefits:

- High Return Potential: With rates often surpassing traditional finance, yield farming can offer significantly higher yields.

- Innovative Ecosystem: The continuous innovation in DeFi means new yield opportunities are regularly emerging.

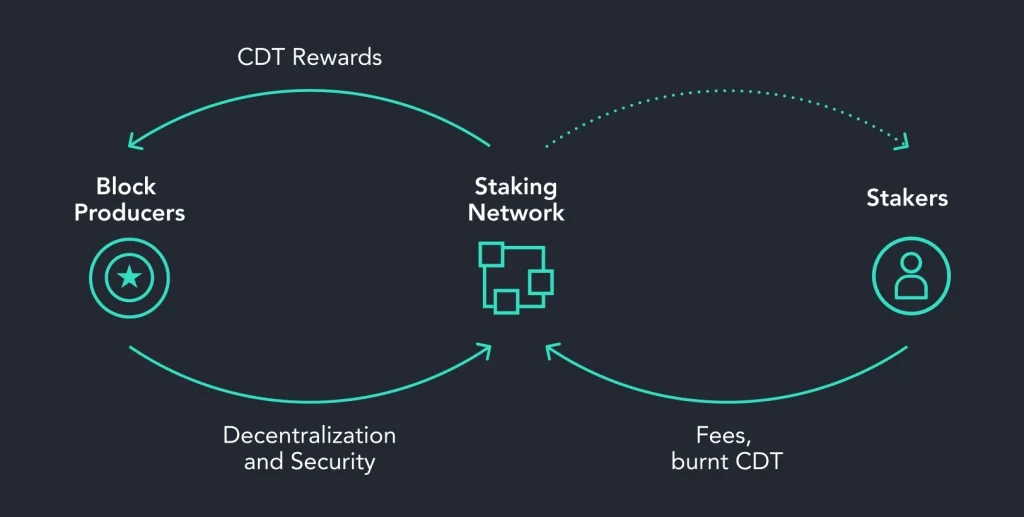

Staking: Securing the Network for Steady Rewards

Staking, another popular method, involves locking up tokens in a blockchain network to support its operations, such as transaction validation and network security. In exchange, stakers receive rewards in the form of additional tokens. This model is particularly popular among proof-of-stake (PoS) networks and has become a cornerstone of many crypto investment strategies.

- Key Benefits:

- Predictable Returns: Compared to yield farming, staking generally offers more consistent and predictable yields.

- Network Security: By staking, investors contribute to the security and efficiency of the blockchain, aligning individual profit with the overall health of the network.

Exploring Other Yield Strategies

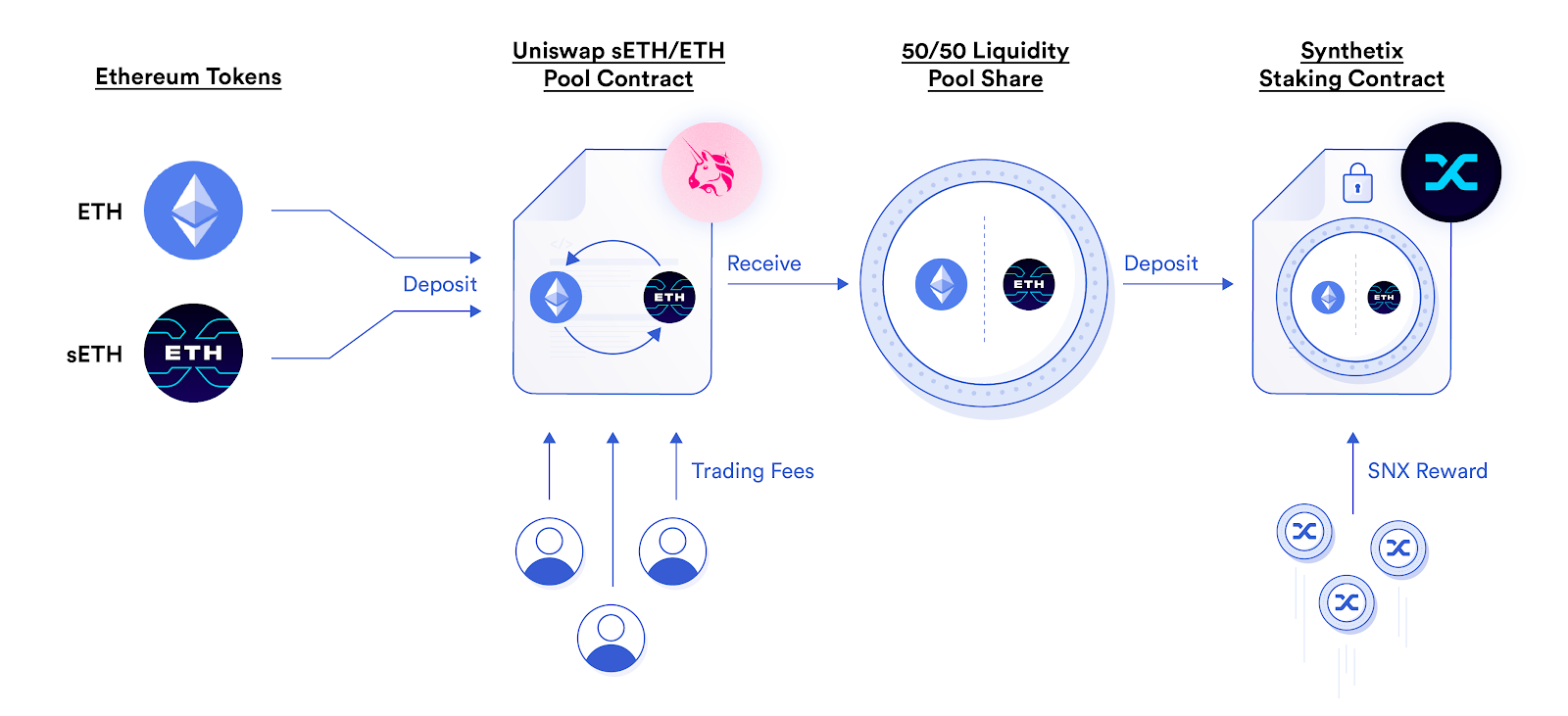

Liquidity Mining: Empowering Decentralized Exchanges

Liquidity mining is a method where investors supply capital to decentralized exchanges (DEXs) or liquidity pools and, in return, earn a share of the transaction fees or additional tokens. This not only boosts the liquidity of the platform but also rewards investors for contributing to the ecosystem’s robustness.

- Key Benefits:

- Dual Rewards: Earn transaction fees alongside bonus tokens, potentially increasing overall returns.

- Ecosystem Growth: Supports the liquidity and functionality of DEXs, paving the way for further innovations.

Lending and Borrowing: Capitalizing on Crypto Assets

Crypto lending platforms allow investors to lend their digital assets to borrowers in exchange for interest payments. This strategy is reminiscent of traditional finance but operates on decentralized protocols that often offer higher yields due to reduced overhead and middlemen.

- Key Benefits:

- Competitive Interest Rates: Yields can be significantly higher than those offered by traditional banks.

- Risk Mitigation: With proper collateral management and over-collateralization, risks can be managed effectively.

The Future of Crypto Yields

As the blockchain and DeFi sectors continue to mature, the methods for generating crypto yields will evolve further. Future innovations might integrate artificial intelligence for optimizing yield strategies, introduce more sophisticated risk management tools, and open up entirely new asset classes for yield generation.

Investors looking to benefit from crypto yields must stay informed, conduct thorough research, and continuously monitor market trends. While the promise of high returns is enticing, it’s essential to balance innovation with caution and ensure that any yield strategy aligns with one’s risk tolerance and investment goals.

Conclusion

By understanding the different types of yield and their underlying mechanisms, investors can make informed decisions, capitalize on emerging trends, and ride the wave of DeFi innovation into a future where every digital asset is an opportunity for growth.