Understanding Crypto Bridging and Swaps

Understanding the mechanisms for transferring and exchanging assets across different blockchains is crucial. Two primary methods facilitate these processes: crypto bridges and crypto swaps. Each serves distinct purposes and operates differently, catering to various user needs.

Understanding Crypto Bridges

Crypto bridges, also known as blockchain bridges, are protocols that enable the transfer of assets and data between separate blockchain networks. Since blockchains like Bitcoin and Ethereum operate independently without native interoperability, bridges provide a solution by connecting these disparate ecosystems.

How Do Crypto Bridges Work?

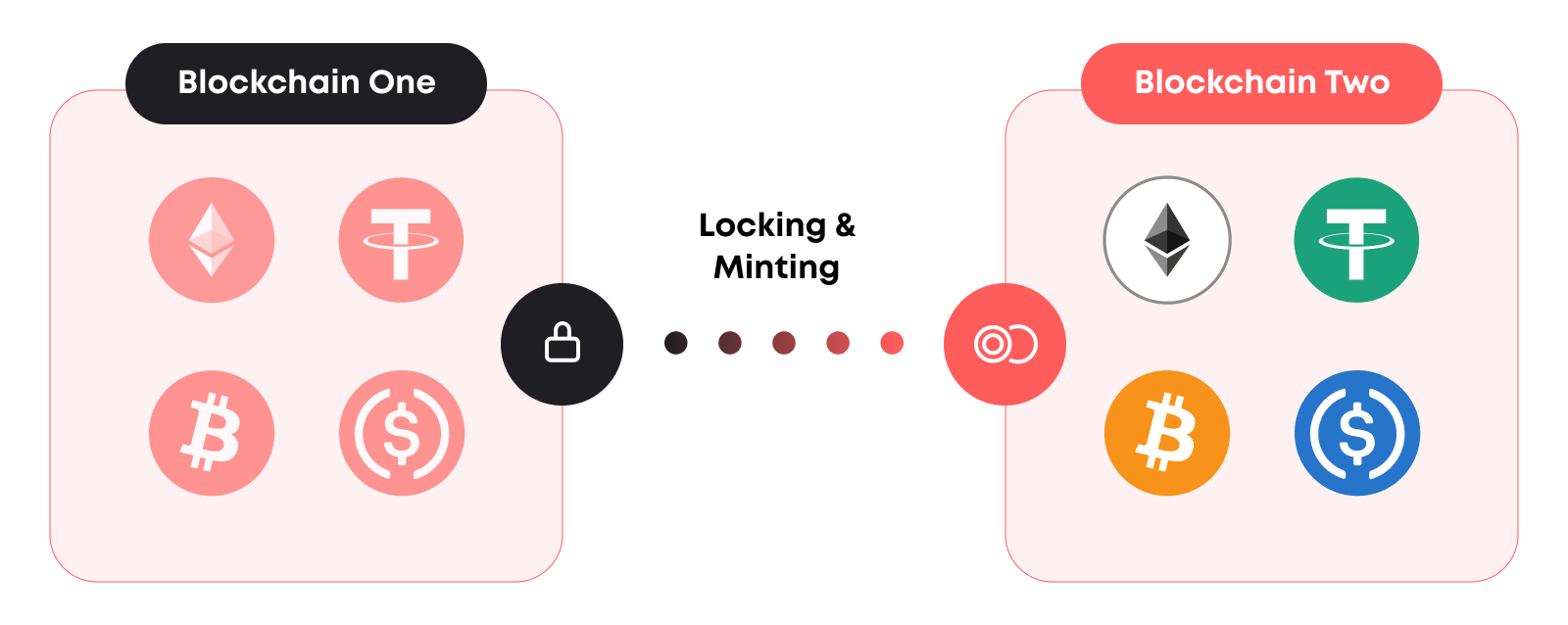

When utilizing a crypto bridge, the original asset isn't moved directly to the new blockchain. Instead, the asset is locked in a smart contract on the source chain, and a corresponding "wrapped" token is minted on the destination chain. This wrapped token represents the original asset and can be used within the new blockchain's ecosystem. For example, Wrapped Bitcoin (WBTC) allows Bitcoin to be utilized on the Ethereum network as an ERC-20 token.

Bridges can be categorized based on their operational trust models:

- Trusted Bridges: These require users to place trust in a central authority or custodian to manage the locked assets and minting process. While they might offer efficiency, they introduce centralization risks.

- Trustless Bridges: Operating through smart contracts, these bridges eliminate the need for intermediaries, relying on code to manage asset locking and minting. This approach aligns with the decentralized ethos of blockchain technology but may involve more complex implementations.

Exploring Crypto Swaps

Crypto swaps involve exchanging one cryptocurrency for another, either within the same blockchain or across different blockchains. Swaps can occur on centralized exchanges (CEXs) or decentralized exchanges (DEXs), each with its own set of characteristics.

How Do Crypto Swaps Work?

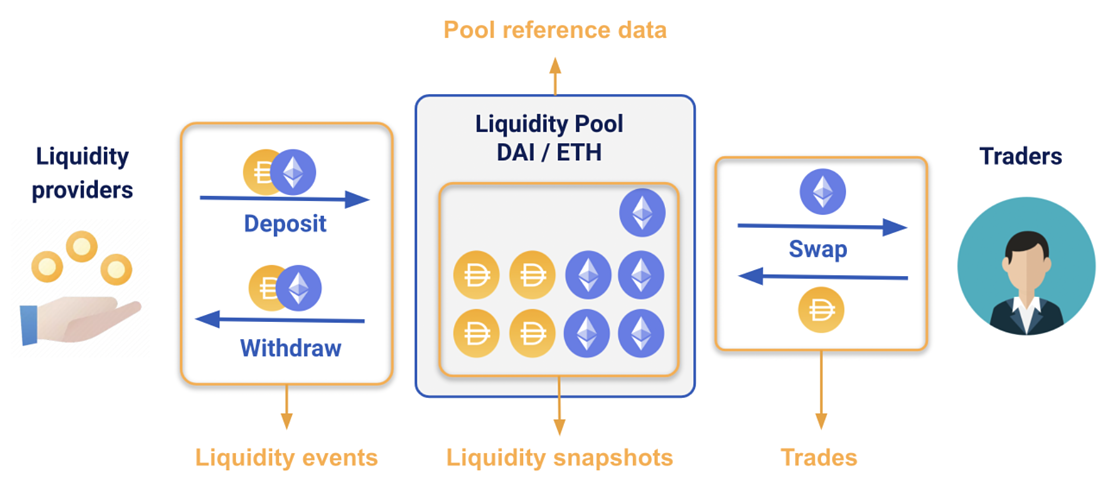

In a swap, a user exchanges a certain amount of one cryptocurrency for the same value in another. On centralized platforms, the exchange handles this by matching buy and sell orders. Decentralized platforms use smart contracts to enable direct trades between users without middlemen.

A special type called cross-chain swaps lets users trade assets between different blockchains without needing a bridge. Technologies like Hash Time-Locked Contracts (HTLCs) make sure both parties meet their swap obligations, or the transaction is canceled, improving security and trust.

Comparing Crypto Bridges and Swaps

While both bridges and swaps enable interaction across blockchain networks, their purposes and mechanisms differ:

- Functionality:

- Bridges: Transfer assets between blockchains by locking and minting tokens, allowing users to utilize their assets in different blockchain ecosystems.

- Swaps: Exchange one cryptocurrency for another, either within the same blockchain or across different blockchains, primarily for trading or diversification purposes.

- Use Cases:

- Bridges: Ideal for users looking to participate in decentralized applications (dApps) or services on a different blockchain without selling their original assets.

- Swaps: Suitable for users aiming to change their asset holdings, speculate on price movements, or access different investment opportunities.

- Security Considerations:

- Bridges: Trusted bridges introduce counterparty risk due to reliance on central authorities, while trustless bridges mitigate this through smart contracts but may have vulnerabilities in code.

- Swaps: Centralized swaps depend on the exchange's security measures, whereas decentralized swaps rely on the robustness of smart contracts and the underlying blockchain.

Choosing Between a Bridge and a Swap

The decision between using a bridge or a swap depends on individual goals and the specific context:

- Use a Bridge If:

- You want to utilize your assets on a different blockchain's dApps or services without converting them into another cryptocurrency.

- You're aiming to take advantage of lower transaction fees or faster processing times on another blockchain.

- Use a Swap If:

- You're looking to diversify your cryptocurrency portfolio by acquiring different assets.

- You aim to hedge against market volatility by holding stablecoins or other cryptocurrencies.

- You're seeking trading opportunities based on market movements.

Using Relay to Swap and Bridge

Using Relay to manage your crypto transactions is straightforward and user-friendly. Here’s how to get started:

- Connect Your Wallet: First, log into Relay and link your digital wallet. Our platform supports a range of wallets that integrate smoothly.

- Choose Hemi Network: From your Relay dashboard, select your active blockchain.

- Input Your Details: Enter the amount you wish to swap or bridge. Relay provides real-time data, so you’re always in the loop about current rates and fees.

- Review and Confirm: Take a moment to review your transaction details. Once everything looks good, confirm the transaction.

- Stay Updated: Relay keeps you informed with real-time notifications, so you always know where your transaction stands.

This simple, streamlined process is designed to make bridging and swapping with Relay as effortless as possible.