Under the Hood: How Cross-Chain Swaps Actually Work

Cross-chain swaps have quickly become essential for seamless crypto trading, allowing users to instantly exchange assets across blockchains without centralized intermediaries. But what exactly powers these impressive swaps? Let's dive into the mechanics of cross-chain technology, breaking down complex concepts like atomic swaps, HTLCs, liquidity pools, and Relay's innovative intent-based architecture.

Defi, Atomic Swaps and HTLCs: Secure, Trustless Exchanges

Atomic swaps enable peer-to-peer trades across different blockchains without intermediaries. They utilize Hash Time-Locked Contracts (HTLCs), specialized smart contracts ensuring secure, trustless swaps. Atomic swaps also act as a bridging mechanism, allowing assets to move between blockchains without the need for centralized intermediaries. Here’s how it works:

- Locking Assets: Both parties lock assets on their respective blockchains using HTLCs, establishing a connection between the two blockchains for the swap.

- Cryptographic Security: Assets unlock only after cryptographic proofs are revealed within a set timeframe.

- Simultaneous Exchange: The process is atomic—either both assets swap simultaneously, or nothing happens, protecting both traders. After the swap is completed, assets are received on the destination chain, ensuring seamless cross-chain transfers.

How Atomic Swaps Work: The Mechanics Behind Trustless Trades

Atomic swaps are at the heart of decentralized finance, empowering users to trade crypto assets directly across different blockchain networks without relying on financial institutions. This process is made possible by smart contracts that bridge tokens between multiple blockchains, ensuring that each transaction is secure, transparent, and trustless. By enabling communication between different networks, atomic swaps allow users to access a wider range of liquidity pools and decentralized exchanges, unlocking new opportunities for trading and investment.

The process works by locking assets on each blockchain involved in the swap, with the smart contract ensuring that the exchange only occurs if both parties fulfill their obligations. This eliminates the need for intermediaries and reduces the risks associated with centralized exchanges. For example, a user can bridge tokens from one blockchain to another, instantly accessing new markets and liquidity. By leveraging blockchain technology, atomic swaps facilitate seamless token transfers and enable users to participate in a truly decentralized crypto ecosystem.

Use Cases for Atomic Swaps: Real-World Applications

Atomic swaps have opened the door to a variety of innovative applications in the cryptocurrency market. One of the most prominent use cases is cross-chain trading, where users can exchange crypto assets directly with peers, bypassing traditional exchanges. This peer-to-peer approach not only increases privacy but also reduces costs and settlement times.

Beyond trading, atomic swaps enable users to participate in decentralized apps (dApps) and DeFi protocols that operate across multiple blockchains. For instance, investors can lend their assets through peer-to-peer lending platforms, earning competitive interest rates without the need for a centralized authority. Atomic swaps also make it possible to provide liquidity to decentralized exchanges, helping to stabilize markets and earn rewards. Additionally, the technology supports flash loans, allowing users to borrow and repay funds within a single transaction, opening up new strategies for arbitrage and investment. As atomic swaps continue to evolve, their role in enabling cross-chain functionality and expanding the reach of DeFi will only grow.

Liquidity Pools: Instant and Continuous Availability

Cross-chain swaps often leverage decentralized liquidity pools, where users deposit assets into smart contract pools, providing liquidity to the pools. When swaps occur:

- Automated Market Makers (AMMs) algorithmically determine the swap rate.

- Trades execute immediately, with minimal slippage, thanks to pooled assets readily available across blockchains. Liquidity pools often contain native tokens from each blockchain, enabling efficient swaps.

Relayer Protocols: Facilitating Smooth Cross-Chain Trades

Relayer protocols, like Relay, are specialized software that act as sophisticated middleware. They facilitate cross-chain communication by securely transmitting transaction data between blockchains. Here’s their role:

- Transaction Coordination: Relayers verify and broadcast cross-chain transaction details, enabling blockchains to communicate transaction information securely.

- Security and Verification: They confirm transactions are valid and final before releasing assets.

- Enhanced Efficiency: Reduces transaction latency, ensuring swift completion of trades.

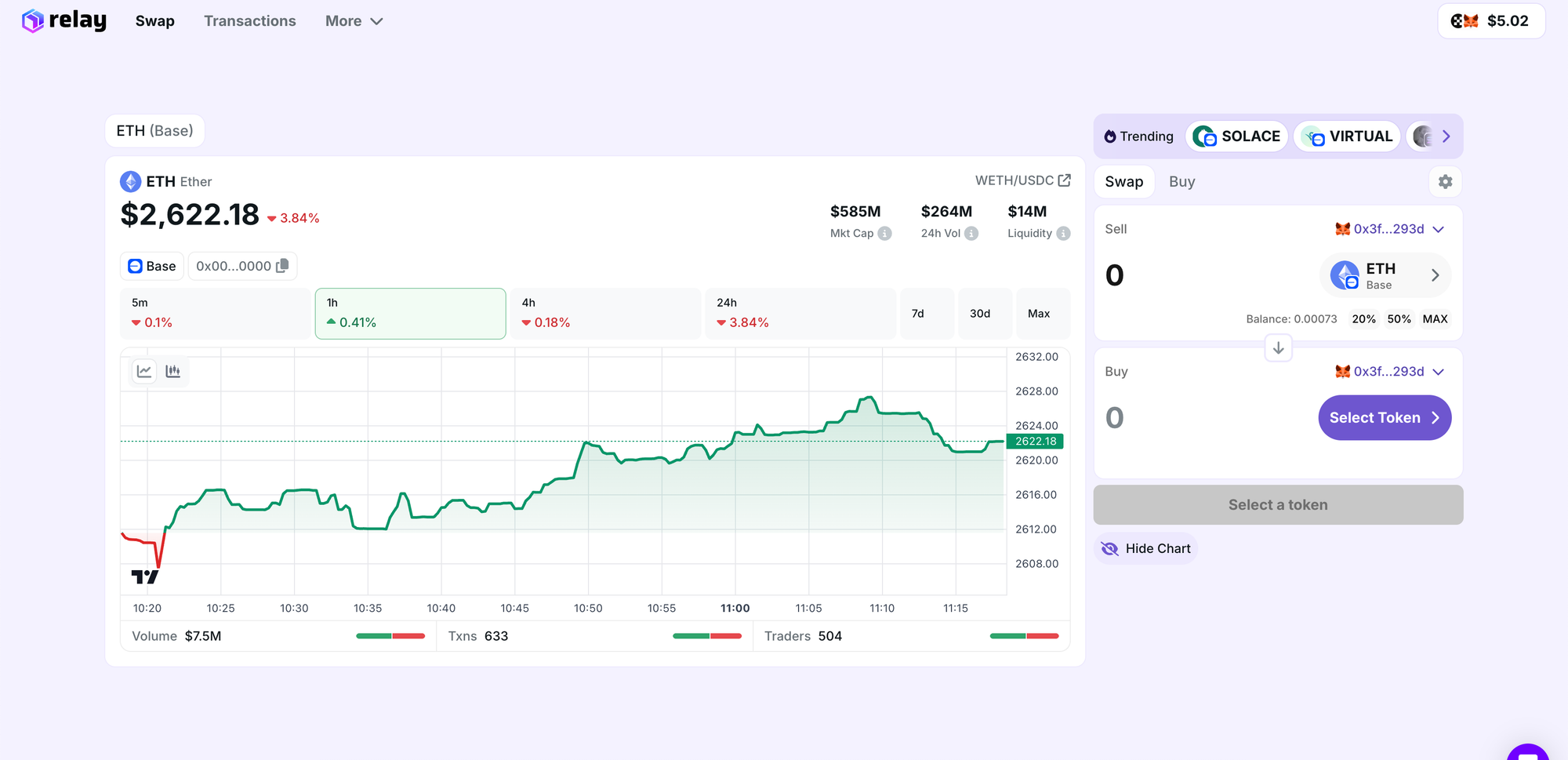

Relay’s Intent-Based Architecture: Next-Level Efficiency

Relay stands out by adopting an innovative intent-based architecture for cross-chain swaps. Rather than matching traditional orders:

- Users broadcast their trade intent (desired tokens and blockchains).

- Relay’s sophisticated algorithm matches intents with optimal cross-chain paths and liquidity.

- Trades execute automatically, finding the best routes instantly across Relay’s extensive relay network. Once intents are matched, assets are securely transferred between blockchains, ensuring ownership and value exchange are handled seamlessly and irreversibly.

This method enhances speed, reduces costs, and significantly improves reliability compared to conventional models. This architecture also supports the secure transfer of values and data across multiple chains.

Technical Requirements: What’s Needed for Atomic Swaps

Executing atomic swaps successfully requires a robust technical foundation. First and foremost, both blockchains involved must support smart contracts and decentralized exchanges to facilitate the swap. A secure and reliable bridge protocol is essential to enable communication between different networks, ensuring that token transfers are executed accurately and efficiently.

The bridge protocol must be capable of handling the transfer of assets between networks, providing transparency throughout the process and safeguarding users’ funds. Security is paramount, as the protocol must protect against potential risks such as double-spending or unauthorized access. By meeting these technical requirements—support for smart contracts, secure bridges, transparent processes, and strong security measures—atomic swaps can deliver a seamless and trustworthy experience for users looking to transfer assets across blockchains.

Challenges and Limitations: Navigating the Hurdles

While atomic swaps offer significant advantages, they also come with their own set of challenges and limitations. One major concern is the volatility of crypto prices, which can impact the value of assets during the transfer process. The complexity of blockchain technology and the need for interoperability between different networks can also present technical obstacles, making it difficult to create seamless connections between chains.

Regulatory uncertainty is another hurdle, as the evolving landscape of cryptocurrency regulations can create confusion for users and investors. Security remains a top priority, as robust bridge protocols are needed to protect users’ assets from potential risks such as hacks or protocol failures. By understanding these challenges—ranging from technical and regulatory issues to market risks—developers and users can work together to create safer, more reliable atomic swap solutions that foster trust and innovation in the blockchain ecosystem.

Implementation and Adoption: Bringing Atomic Swaps to Life

For atomic swaps to reach their full potential, widespread implementation and adoption are essential. Education plays a key role, as users need to understand both the benefits and the risks involved in using atomic swaps. User-friendly platforms and intuitive interfaces can help demystify the process, making it accessible to a wider range of users, from beginners to experienced investors.

The creation of new cryptocurrency assets and the expansion of DeFi platforms further drive adoption, offering users more options for trading and investment. Clear regulations and guidelines are also important, as they provide a framework that builds trust and encourages participation. By focusing on education, usability, innovation, and regulatory clarity, the crypto community can accelerate the adoption of atomic swaps and unlock new possibilities for decentralized finance.

Future Developments: What’s Next for Trustless Exchanges

The future of atomic swaps is bright, with ongoing advancements poised to reshape decentralized finance. Integration with other DeFi protocols is on the horizon, enabling the creation of more complex financial instruments and expanding the capabilities of decentralized exchanges. As cross-chain trading becomes more prevalent, users will benefit from increased liquidity and a broader selection of assets to trade.

Improvements in bridge protocols and the development of more secure, efficient solutions will help mitigate risks and encourage greater adoption. As blockchain technology continues to evolve, we can expect to see new use cases and innovative applications emerge, further cementing atomic swaps as a cornerstone of decentralized finance. The ongoing evolution of trustless exchanges promises to deliver greater transparency, security, and opportunity for users across the cryptocurrency market.

Simplifying Complexity, Ensuring Reliability

Though cross-chain swaps rely on advanced cryptographic concepts and decentralized protocols, platforms like Relay abstract these complexities, delivering effortless user experiences without sacrificing security or efficiency.

Users only need an internet connection to access and benefit from these simplified cross-chain swap platforms.

Final Thoughts

Understanding the mechanics of cross-chain swaps—from atomic swaps and HTLCs to advanced relayer networks and intent-based protocols—highlights the innovation driving crypto interoperability. Relay's technology exemplifies this innovation, setting a new standard for secure, fast, and reliable cross-chain trading.

Explore the technical elegance behind cross-chain swaps and experience next-gen crypto trading efficiency with Relay today.