Top Cross-Chain Swap Tools in 2025

DeFi is no longer confined to one blockchain. In 2025, crypto traders and developers are using cross-chain swap tools to move assets across networks at will. Whether you’re chasing yield on multiple chains or simply looking for the fastest crypto swaps, the right bridge can make all the difference.

In this article, we’ll explore the best cross-chain bridges and swap platforms of 2025 – what they offer in terms of speed, supported blockchains, liquidity, security, and fees – in an unbiased comparison. By the end, you’ll understand today’s top interoperability tools in DeFi and be equipped to choose the one that fits your needs.

Why Top Crypto Swaps Matter in 2025

DeFi has fragmented across dozens of Layer-1 and Layer-2 networks. Interoperability tools in DeFi – especially cross-chain bridges and swappers – have become essential infrastructure. They help to:

- Reduce liquidity fragmentation

- Simplify user experience

- Enable composability

- Support multichain growth

To address liquidity fragmentation, many exchanges now support a large selection of assets for cross-chain swaps, giving users access to a wider variety of coins and trading opportunities.

In short, cross-chain swap tools are the interoperability lifeline of a multichain DeFi world.

Introduction to Cross-Chain Swaps

Cross-chain swaps are transforming the crypto space by allowing users to swap crypto assets seamlessly across different blockchain networks. This breakthrough means crypto traders are no longer limited to trading within a single blockchain—they can now access a much broader range of digital assets, increasing their trading opportunities and flexibility. For advanced traders, cross-chain swaps open up new strategies, such as arbitrage between networks, and help boost overall liquidity in the market. By enabling direct swaps between assets like Bitcoin and tokens on other chains, these tools make it easier for traders and users to access the best trading volumes and take advantage of the rapidly evolving crypto landscape.

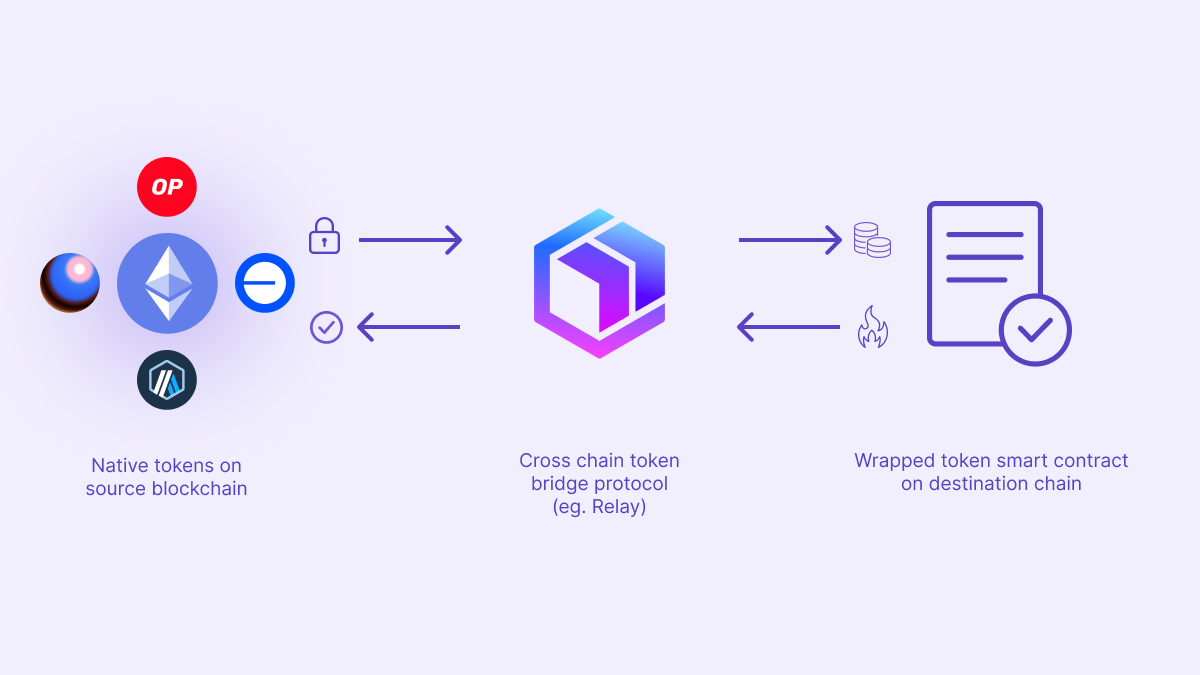

How Cross-Chain Swaps Work

Cross-chain swaps leverage smart contracts and decentralized liquidity pools to make exchanging cryptocurrencies between different blockchains fast, secure, and efficient. When a user initiates a swap, the platform locks their assets in a smart contract, then creates a corresponding transaction on the destination blockchain.

Once the transaction is confirmed, the smart contract releases the equivalent assets to the user on the new network. This process eliminates the need for multiple transactions and reduces gas fees, making swaps more cost-effective. By using decentralized liquidity, these platforms ensure that users can access deep liquidity without relying on a centralized exchange, enhancing both security and the overall trading experience.

Key Features to Compare

We’ll compare platforms based on:

- Best rates & floating rates

- Low fees (including taker fees and network fees)

- Supported coins & tokens

- Advanced trading features (limit orders, margin trading, futures trading, advanced charting)

- Trading volume & market cap

- Wallet and crypto wallet integration

- Account setup and management

- Educational resources

- Ability to buy sell, purchase crypto, stake crypto, and earn rewards

- Platform offers and one platform convenience

- Transaction history and security (including securities compliance)

- Examples: Kraken Pro, Coinbase offers

Security and Trust in Cross-Chain Swaps

Security is a top priority for any crypto exchange or platform offering cross-chain swaps. Leading cryptocurrency exchanges implement advanced security measures such as multifactor authentication, two-factor authentication, and cold storage to safeguard user assets.

Many platforms also provide insurance coverage for customer assets, giving users extra peace of mind. Decentralized liquidity pools further enhance security by reducing the risk of price manipulation and central points of failure. By choosing reputable exchanges with strong security protocols, users can trade crypto assets confidently, knowing their funds and access are protected throughout the swap process.

Top Cross-Chain Swap Tools in 2025

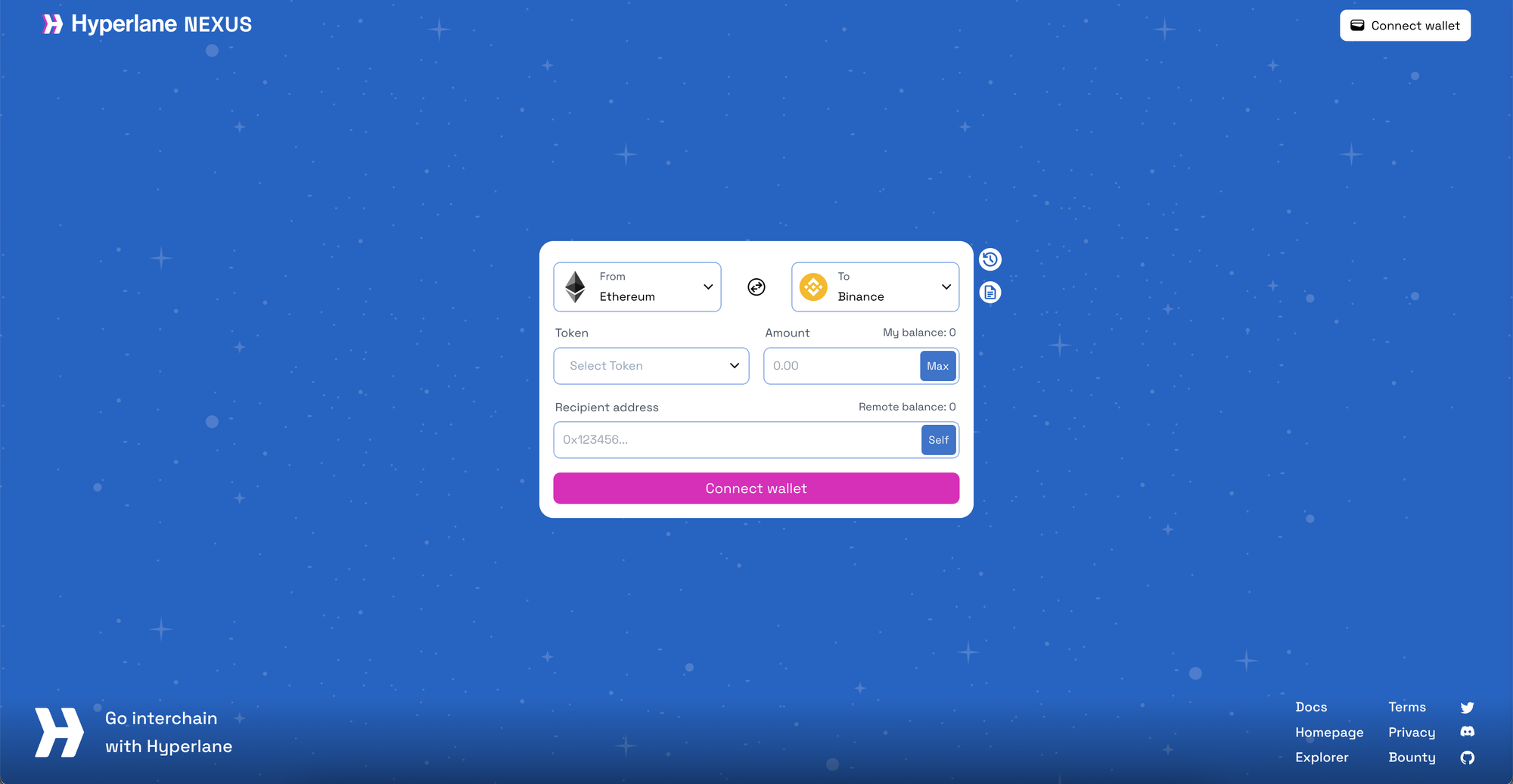

Hyperlane – Open-Ended Interoperability

Hyperlane is a permissionless protocol with modular security and broad VM support across EVM, Cosmos, and Solana-style chains.

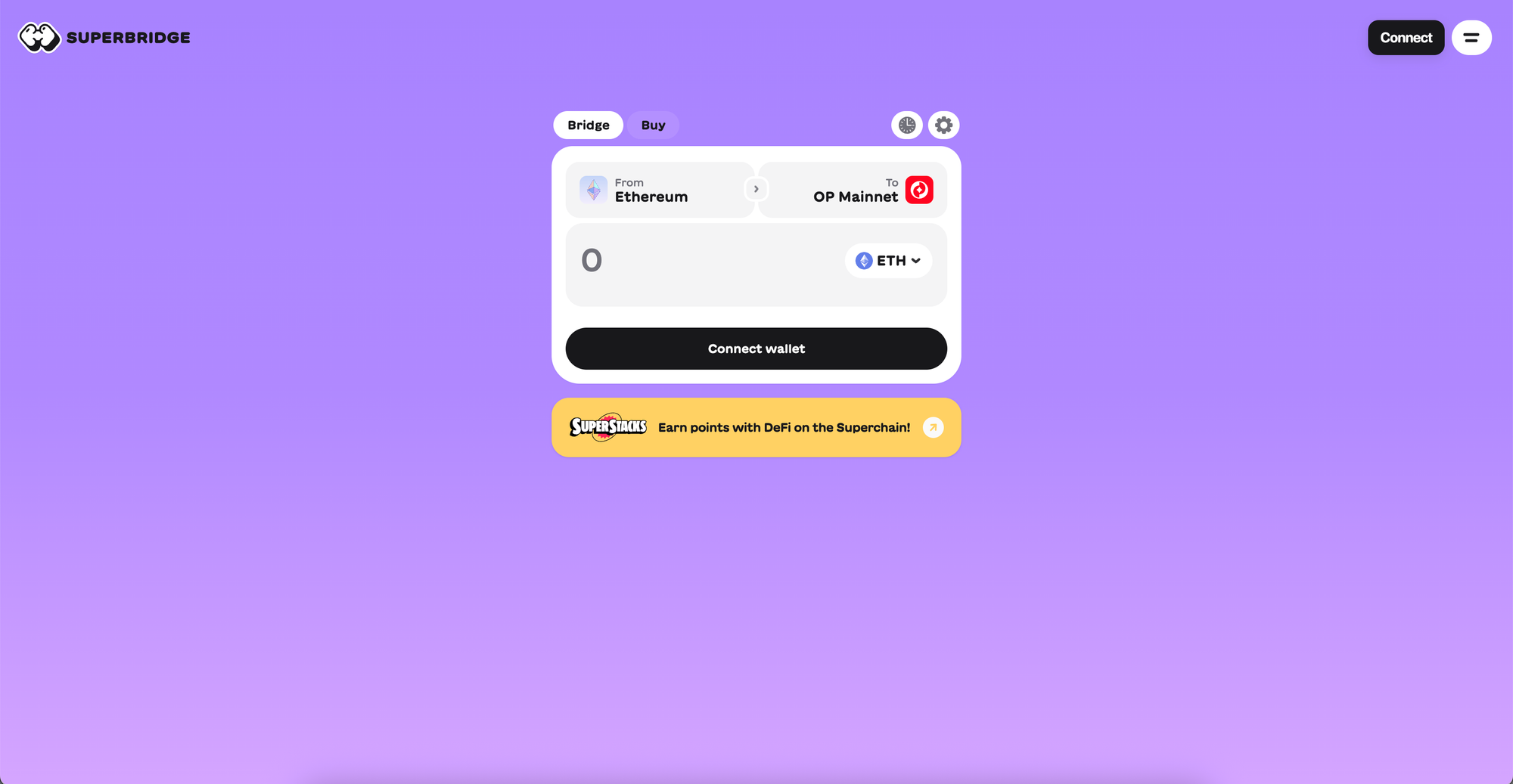

Superbridge – Aggregator for the Superchain Era

Superbridge connects Ethereum and its rollup ecosystem (Base, OP Mainnet, etc.) through an optimized routing interface.

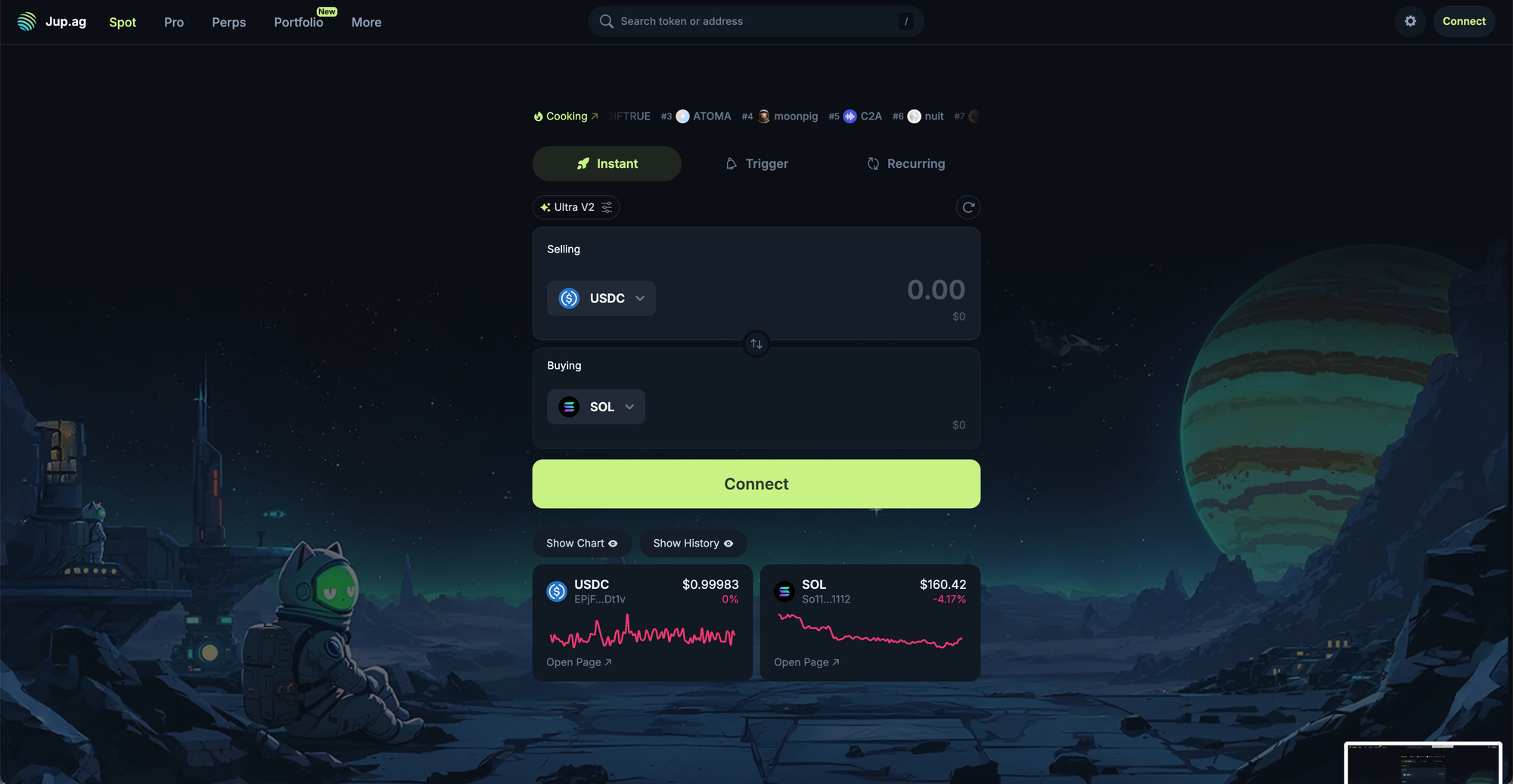

Jupiter – Solana’s Swap Powerhouse

Jupiter is the leading DEX aggregator on Solana, providing deep liquidity and routing across native DEXs, with some cross-chain functionality. Jupiter also enables users to buy sell a wide range of Solana-based assets.

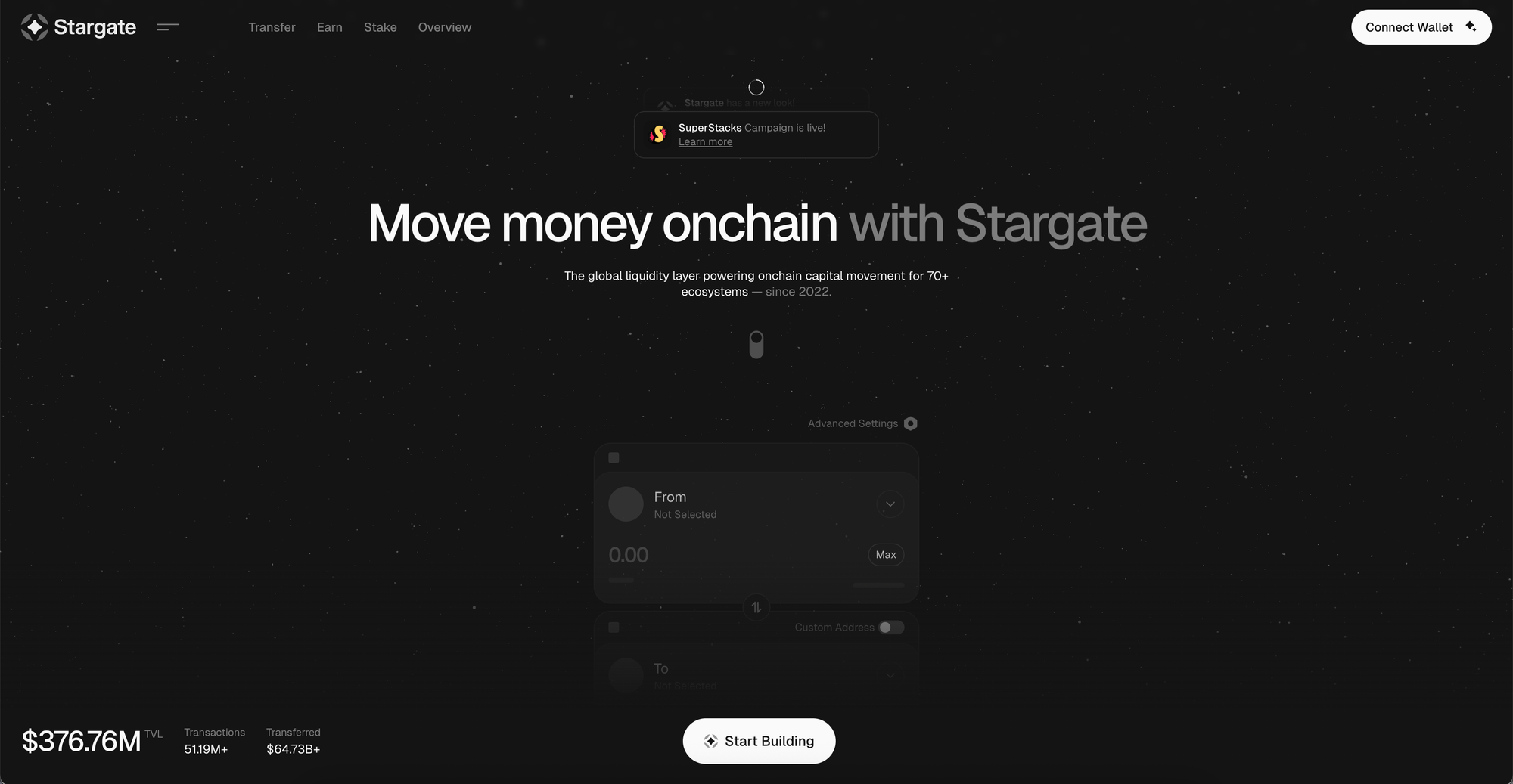

Stargate – Unified Liquidity, Instant Finality

Built on LayerZero, Stargate offers instant, native asset swaps with shared liquidity pools and trust-minimized messaging. To initiate a cross-chain swap, Stargate requires users to send funds to a deposit address, ensuring secure and accurate transactions.

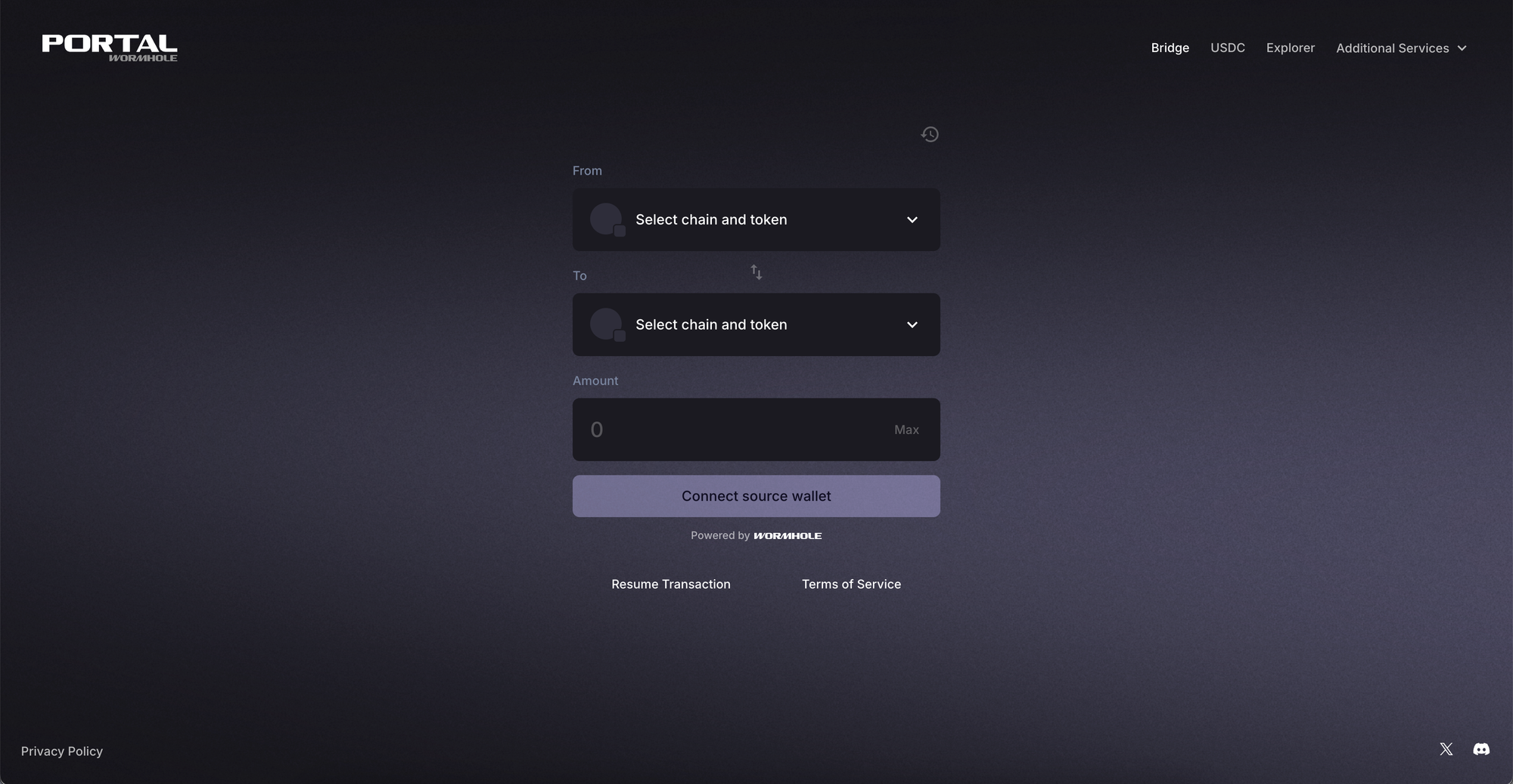

Wormhole – Broadest Chain Support and Versatile Messaging

Wormhole connects 30+ chains with message-passing and asset bridging through its Guardian-secured network.

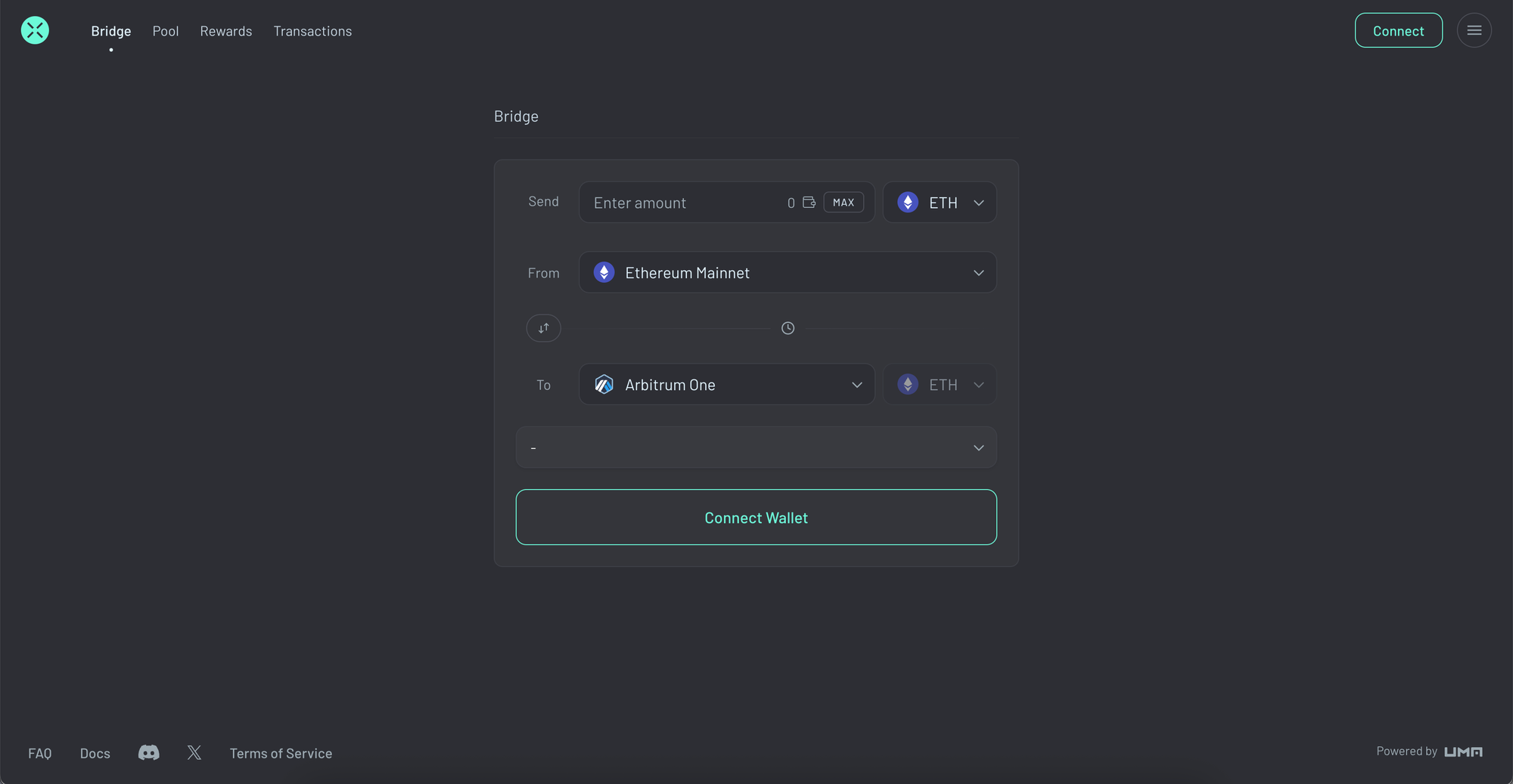

Across – Optimistic Speed for Layer-2 Transfers

Across uses bonded relayers and a single Ethereum pool to provide fast, low-cost bridging between L1 and L2 chains. Users should be aware that network fees may apply when transferring assets with Across.

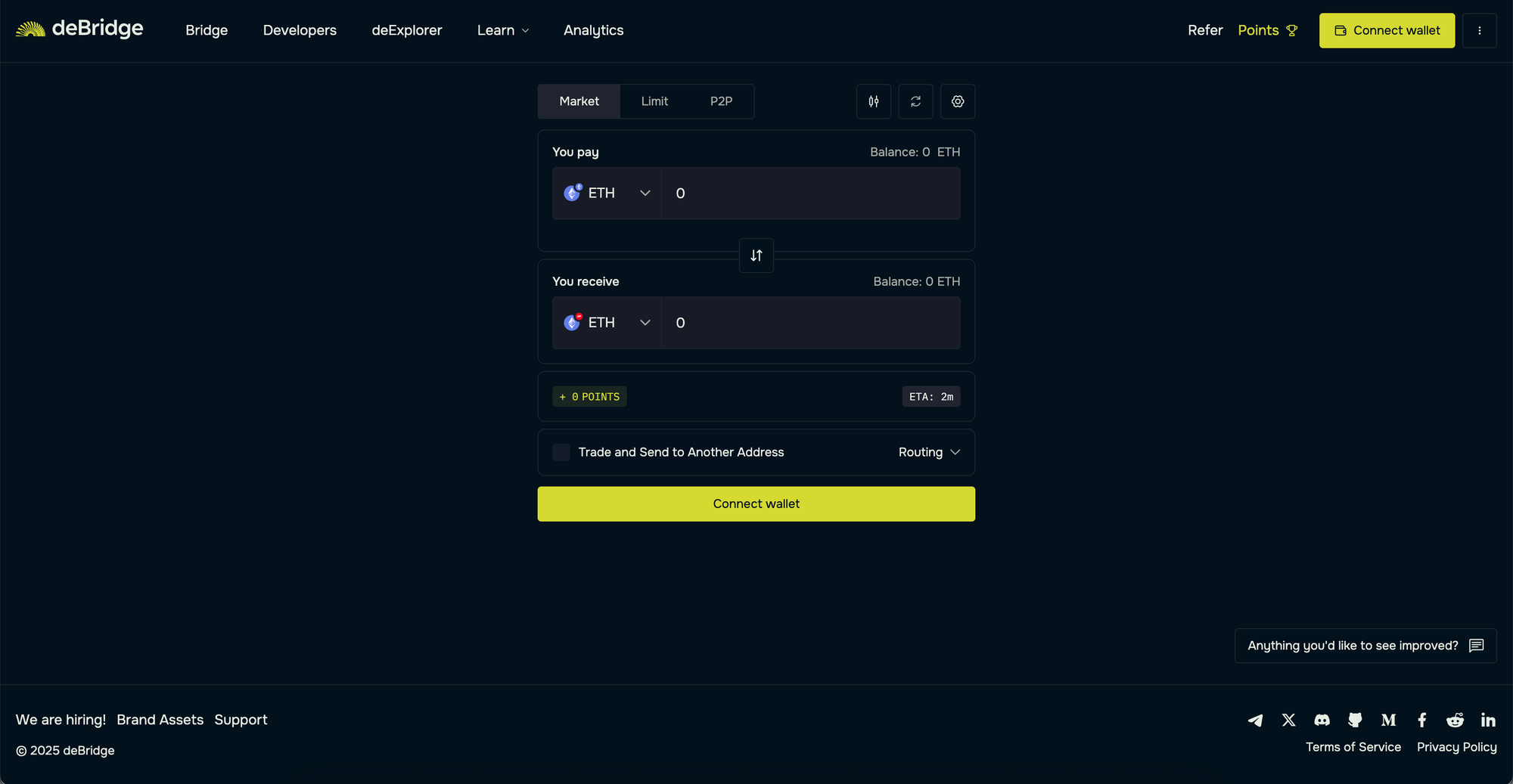

deBridge – High-Speed “Any-to-Any” Protocol

deBridge combines DEX aggregation and validator-secured messaging to enable lightning-fast cross-chain swaps, allowing users to execute fast and secure cross-chain trades.

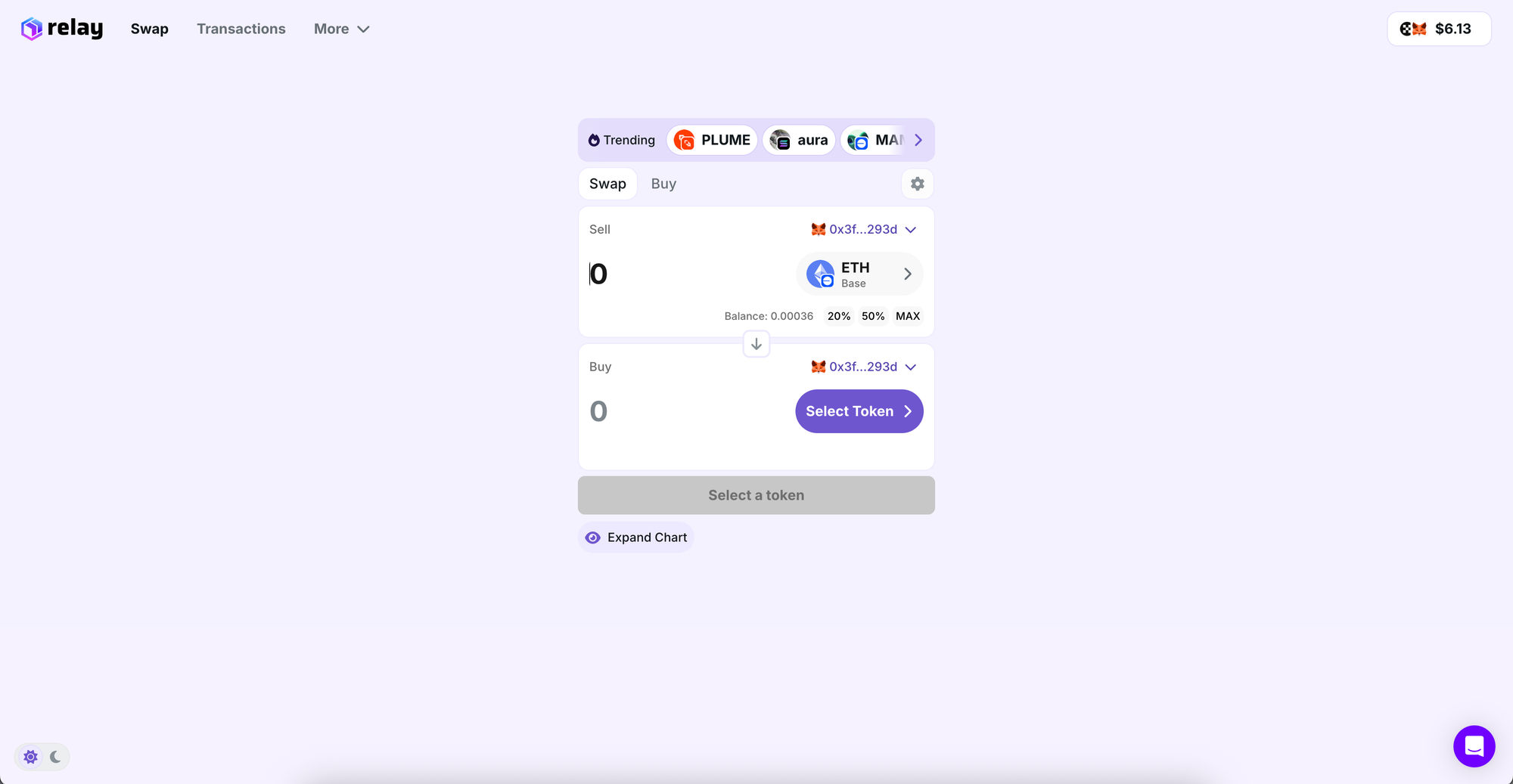

Relay – Instant Swaps

Relay offers near-instant cross-chain swaps by using a network of bonded relayers who pre-fund transactions across 73+ supported chains, allowing users to quickly buy and sell assets across multiple chains.

Crypto Swap Technology: Innovations Powering 2025

The technology behind crypto swaps is advancing rapidly, with new innovations making it easier and safer to trade crypto assets across multiple blockchains. Decentralized finance (DeFi) protocols are at the forefront, enabling the creation of decentralized liquidity pools that support secure and transparent trading. Atomic swaps allow users to exchange cryptocurrencies directly between different networks without intermediaries, increasing both efficiency and security. Layer 2 scaling solutions are also reducing transaction costs and improving speed, making cross-chain swaps more accessible to a wider range of users. These advancements are driving greater liquidity, security, and market participation, helping users and traders get the most out of their crypto swap experience.

Comparison Table

| Platform | Speed | Chains Supported | Liquidity Model | Security Model | Fees |

|---|---|---|---|---|---|

| Hyperlane | Fast (per chain finality) | EVM, Solana, Cosmos | Developer-deployed routes | Customizable ISM modules | Varies |

| Superbridge | Fast (aggregator) | Ethereum, Base, OP Stack | Uses external bridges | Inherits from route chosen | Low |

| Jupiter | Instant (on Solana) | Solana (+ EVM via integrations) | DEX aggregator (Solana only) | Smart contracts + external bridge | Minimal |

| Stargate | Instant finality | 8+ major EVM chains | Unified native asset pools | LayerZero oracle + relayer model | ~0.06% + gas |

| Wormhole | 1–2 min | 30+ L1/L2 chains | Lock/mint (wrapped tokens) | Guardian set (19-node multisig) | Varies |

| Across | Seconds (optimistic) | Ethereum, Arbitrum, Optimism | Single L1 pool + relayers | Bonded relayers with fraud proofs | ~0.05% |

| deBridge | Very fast | 15+ chains (EVM + Solana) | DEX + validator execution | Validator quorum with slashing | Dynamic |

| Relay | Instant (seconds) | 73+ supported chains | Relayers with funds on each chain | Bonded relayers (slashable) | Relayer fee (~80% cheaper) |

The Future of Cross-Chain Swaps and Crypto Trading

Looking ahead, the future of cross-chain swaps and crypto trading is bright. As technology and infrastructure continue to evolve, more users will discover the benefits of seamless swaps and integrated trading features. Innovations like quantum-resistant cryptography and improved consensus algorithms will further enhance security and efficiency. The integration of cross-chain swaps with other financial services—such as lending, borrowing, and staking—will create a more comprehensive crypto trading ecosystem. As the crypto space matures, traders, investors, and users can expect new opportunities to emerge, driving higher trading volumes and broader adoption of digital currencies across the global market.

Final Thoughts

These platforms are among the best crypto options for cross-chain swaps, offering seamless experiences for customers who want to swap bitcoin and other cryptos. The following are some of the best crypto exchanges for seamless cross-chain trading.

Every cross-chain tool has its strengths. Whether you’re looking for:

- Maximum speed: Try Relay, Stargate, or Across

- Broadest chain support: Look into Relay, Wormhole or deBridge

- Best UX on specific chains: Use Jupiter for Solana, Superbridge for Base/Optimism & Relay for Abstract.

We encourage you to explore and compare for yourself. And if you want to experience instant, reliable swaps across nearly every chain, check out Relay today — no sign-up required.

Happy swapping!