Relay Vaults Are Live: Powering Crosschain Liquidity with Yield

We're excited to introduce Relay Vaults, a key infrastructure upgrade enabling permissionless liquidity provisioning across the Relay Protocol - designed to enhance crosschain liquidity while rewarding participants through sustainable onchain yield.

Vaults are not just another yield farm. They're a fundamental part of how Relay scales crosschain transactions.

What Are Relay Vaults?

Relay Vaults are ERC4626-compliant smart contracts that accept token deposits, generate base yield from integrated lending protocols (like Aave), and offer boosted yield when the liquidity is actively used by solvers to rebalance assets across chains.

With Relay Vaults, any user can become a liquidity provider (LP) and help improve the speed, efficiency, and cost of crosschain swaps - while earning real yield in return.

Why Vaults Matter for the Crosschain Economy

Relay connects users and liquidity across L2s, L3s, and appchains. But to support instant transactions across networks, solvers need to constantly rebalance liquidity - a costly and operationally intensive process.

Relay Vaults provide a capital-efficient solution:

- Vaults allow idle capital to earn base yield.

- When that capital is used for rebalancing, LPs earn additional rewards.

- Solvers gain on-demand access to shared liquidity pools.

- Users experience faster, cheaper crosschain transfers.

It’s a win-win for LPs, solvers, and the entire ecosystem.

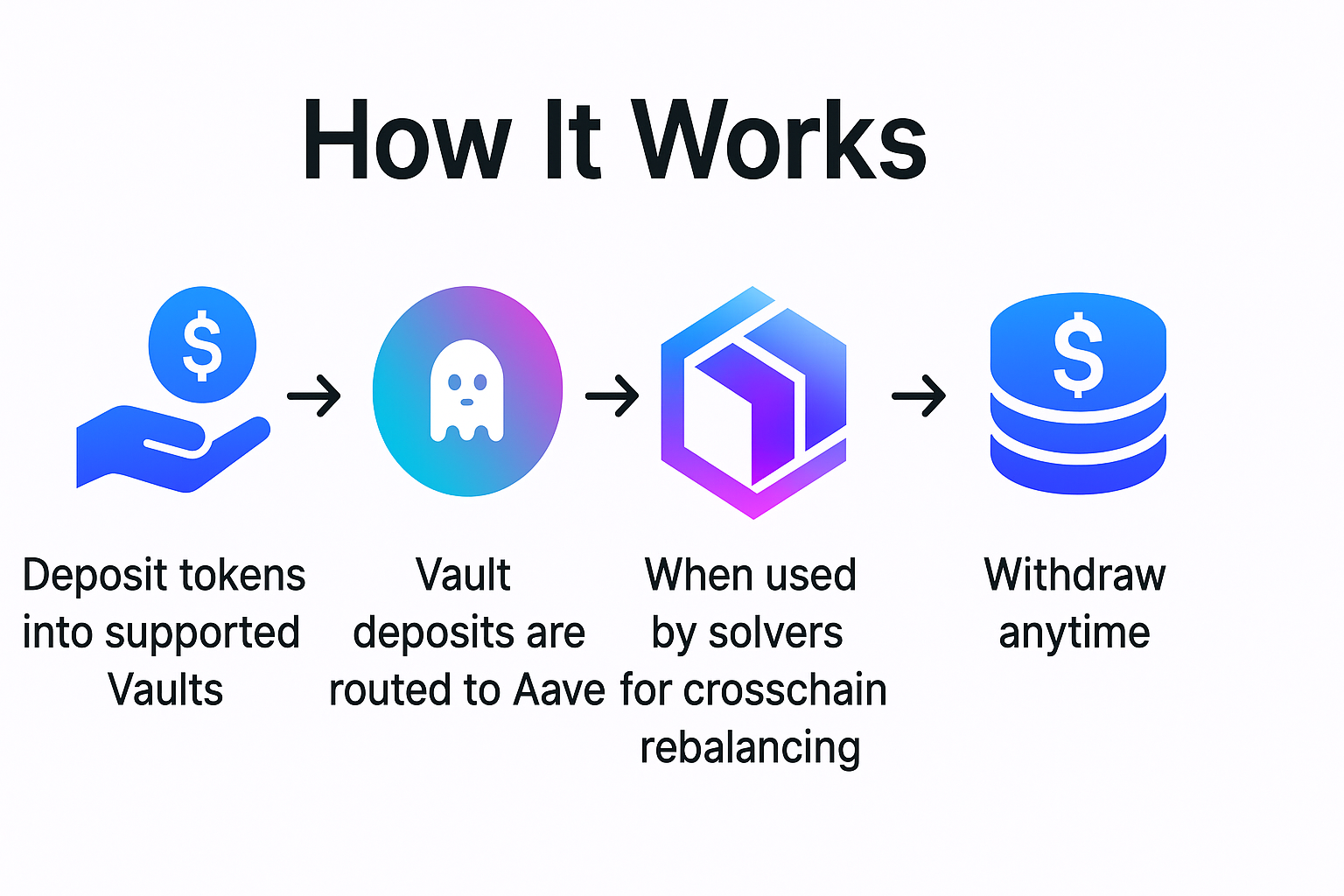

How It Works

Here’s how you interact with Relay Vaults:

- Deposit tokens into supported Vaults (initially live on Ethereum Mainnet and Arbitrum).

- Vault deposits are routed to Aave, where they accrue a base lending yield.

- When used by solvers for crosschain rebalancing, your funds earn additional yield.

- Withdraw anytime - your assets remain composable and non-custodial.

This dual-yield structure means LPs earn consistently, while also contributing to a more efficient protocol architecture.

Multi-Chain Support by Default

Vaults are designed to be chain-agnostic and natively support crosschain rebalancing. A single Vault deployment can support activity across multiple L2s or L3s.

This unlocks:

- Higher capital efficiency

- Better solver incentives

- Improved user experience on emerging networks

Early deployments are live on Ethereum and Arbitrum, with more networks and strategies on the roadmap.

Developer-Friendly & Open Source

Relay Vaults are:

- Open-source (GitHub)

- Modular and composable

- Backed by a dedicated Vaults Indexer API for easy data access: vaults-api.relay.link

Builders can integrate Relay Vaults into wallets, bridges, DeFi protocols, and explorer tools with minimal friction.

For the Community: Become a Liquidity Provider

If you’ve been following Relay and are looking for a way to contribute, this is your chance.

As an LP, you:

- Support the core mechanics of crosschain payments

- Earn passive, real onchain yield

- Help shape a more liquid and accessible ecosystem

You can interact with Vaults via:

- Relay App UI

- Direct smart contract calls

- Etherscan/Blockscout interfaces

What’s Next?

Relay Vaults are just one piece of the protocol stack - but a crucial one. They enable the scalable liquidity layer Relay needs to fulfill its mission: fast, cheap, and open crosschain payments.

Expect to see:

- Support for more assets and strategies (e.g., Morpho, Compound)

- Deployment on additional chains and L3s

- Governance and reward programs for LPs and vault contributors

Useful Links

- Try Vaults: go.relay.link/tryvaults

- Docs: docs.relay.link/references/protocol/vaults/overview

- API for Developers: vaults-api.relay.link

- GitHub: github.com/relay-network