Internet Capital Markets 101: Onchain Investing and the Future of Finance

The financial world is undergoing a seismic shift. Traditional capital markets, long dominated by centralized institutions and gatekeepers, are being reimagined through the lens of blockchain technology. Enter Internet Capital Markets (ICMs): a revolutionary approach that democratizes access to investment opportunities by tokenizing assets and ideas directly onchain.

What Are Internet Capital Markets?

Internet Capital Markets represent a decentralized framework where assets—ranging from startups and real estate to digital art and even internet memes—are tokenized and traded on blockchain platforms. This model eliminates traditional barriers to entry, allowing anyone with an internet connection to invest in projects they believe in.

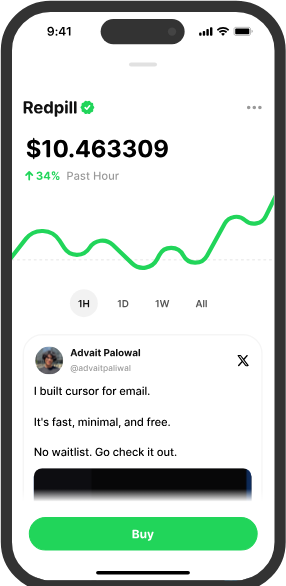

Platforms like Believe.app exemplify this trend, enabling creators to launch tokens tied to their projects, which investors can buy and trade. This approach not only accelerates the fundraising process but also fosters a community-driven investment ecosystem.

The Rise of Onchain Investing

Onchain investing leverages blockchain's transparency and security to offer real-time insights into asset performance and ownership. Unlike traditional markets, where information asymmetry can disadvantage retail investors, blockchain ensures that all participants have equal access to data.

Moreover, the use of smart contracts automates various aspects of the investment process, from dividend distributions to governance decisions, reducing the need for intermediaries and lowering operational costs.

Benefits of Internet Capital Markets

- Accessibility: ICMs open up investment opportunities to a global audience, removing geographical and financial barriers.

- Liquidity: Tokenized assets can be traded 24/7, providing investors with greater flexibility compared to traditional markets.

- Transparency: Blockchain's immutable ledger ensures that all transactions are recorded and verifiable, enhancing trust among participants.

- Efficiency: Automated processes reduce administrative overhead, leading to faster transaction settlements and lower fees.

Challenges and Considerations

While ICMs offer numerous advantages, they also present challenges:

- Regulatory Uncertainty: The evolving nature of blockchain regulations can pose risks for both issuers and investors.

- Market Volatility: The nascent stage of many tokenized projects can lead to significant price fluctuations.

- Due Diligence: Investors must conduct thorough research, as the ease of token creation can sometimes lead to projects lacking substance.

The Future of Finance

The momentum behind Internet Capital Markets suggests a transformative impact on the financial industry. As more assets become tokenized and platforms evolve, we can anticipate a more inclusive, efficient, and transparent financial ecosystem.

For investors and innovators alike, embracing the principles of ICMs could unlock unprecedented opportunities in the digital age.

Note: This blog post is intended for informational purposes only and does not constitute financial advice. Always conduct your own research before making investment decisions.