Institutional Crypto Trading: Cross-Chain Exchanges and Internet Capital Markets

As blockchain matures and institutional engagement intensifies, new paradigms like cross-chain exchanges and Internet Capital Markets (ICMs) are reshaping the financial landscape. For institutional investors and fintech professionals, understanding these innovations is critical to maintaining competitive advantage.

The Emergence of DeFi in Internet Capital Markets

Internet Capital Markets represent a profound shift—traditional capital markets are merging with blockchain technology, enabling tokenization of diverse asset classes, from equities and bonds to real estate and commodities. These tokenized assets can now trade globally, seamlessly, and continuously, bridging geographical and regulatory divides. However, existing regulation and regulations present significant challenges for financial institutions seeking to enter blockchain-based markets, as they must navigate complex compliance requirements and adapt to evolving legal frameworks.

This democratization provides institutions, including financial institutions, unprecedented access to liquidity, diversified asset classes, and innovative investment instruments, fostering a truly global market ecosystem that allows them to operate beyond the constraints of traditional regulations.

Cross-Chain Exchanges: The Backbone of Decentralized Finance

At the heart of ICMs are cross-chain exchanges, sophisticated platforms enabling seamless and instant token trades across multiple blockchain networks. Unlike conventional cryptocurrency exchanges, which handle significant transaction volumes but still represent a small fraction of total financial activity and may have accessibility limitations, cross-chain exchanges eliminate barriers, allowing institutions to move assets fluidly between blockchains like Ethereum, Solana, Avalanche, and Binance Smart Chain.

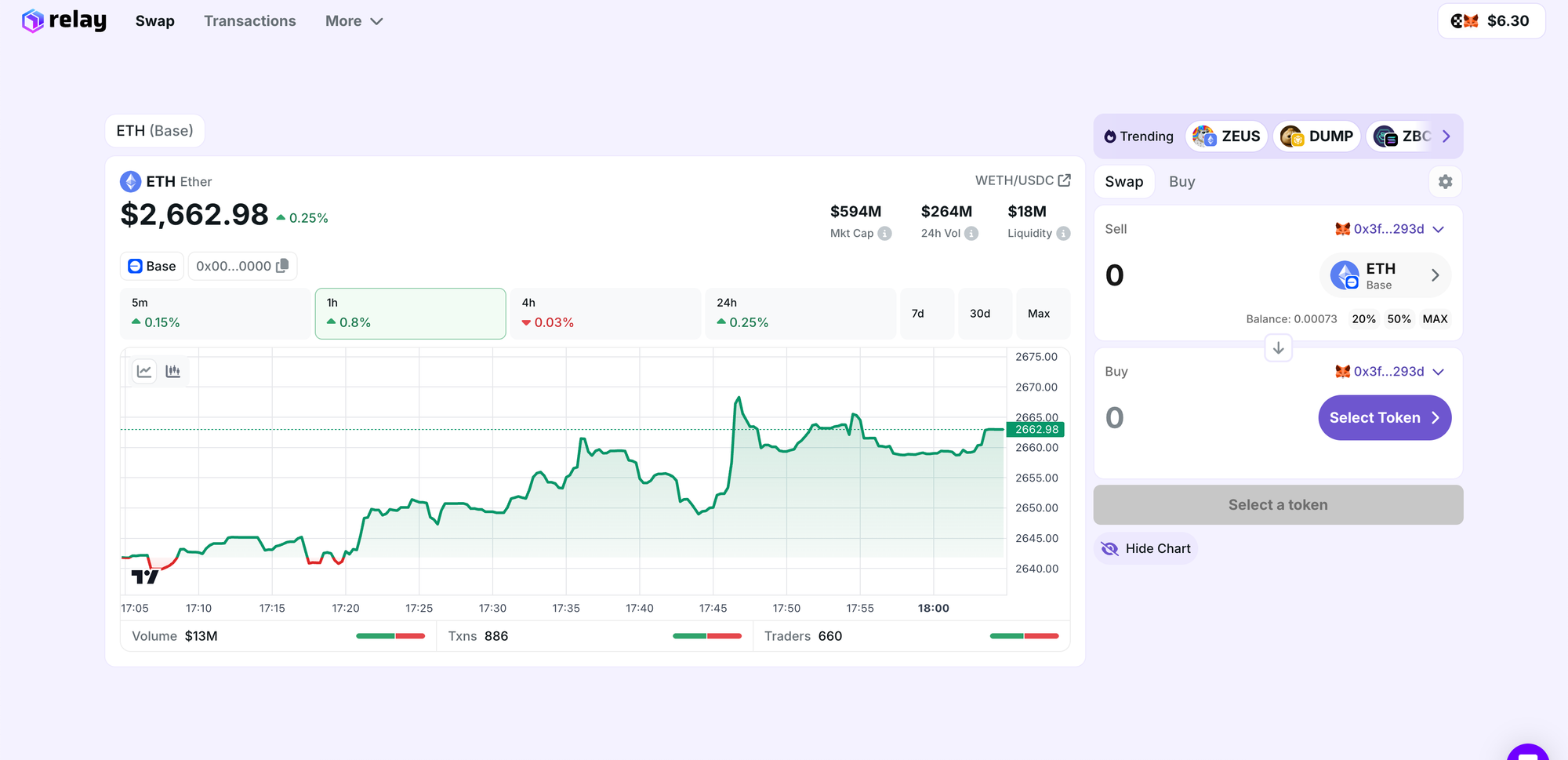

Platforms like Relay exemplify this by providing instantaneous transactions at significantly reduced costs—critical factors for institutional-scale trading and liquidity management. These platforms are accessible to anyone with an internet connection.

Strategic Advantages for Institutional Investors

Cross-chain exchanges and ICMs deliver strategic benefits:

- Enhanced Market Accessibility: Global, continuous trading across multiple asset classes and blockchain ecosystems, enabling institutional investors to access the cryptocurrency market for investing.

- Cost Efficiency: Reduced transaction fees and operational costs via streamlined cross-chain protocols.

- Liquidity Optimization: Ability to quickly redeploy assets across chains to capture arbitrage opportunities and manage portfolio risks effectively when investing in the cryptocurrency market.

Security and Compliance Considerations

For institutions, navigating this landscape requires stringent attention to security and regulatory compliance:

- Regulatory Clarity: Stay updated with global regulatory frameworks around tokenized assets to mitigate compliance risks.

- Custodial Security: Implement robust custody solutions—consider partnerships with regulated custodians specializing in digital assets.

- Operational Integrity: Prioritize cross-chain exchange platforms with transparent operations, comprehensive audits, and proven resilience against cyber threats. Secure and well-audited software is essential in the compliance process to ensure the integrity of all transactions.

Unlike the formal and often lengthy compliance process required by a traditional bank, DeFi platforms streamline these steps through automated software, reducing paperwork and intermediaries.

The Future of Institutional Crypto Trading

Institutional participation in blockchain-driven markets signals the broader integration of decentralized technology into mainstream finance. In DeFi, money is often created through mechanisms like mining or staking, with bitcoin serving as a foundational cryptocurrency that enables direct peer-to-peer transactions. Internet Capital Markets and cross-chain exchanges are not merely trends—they represent foundational shifts, presenting transformative opportunities for innovative institutions ready to embrace blockchain’s full potential.

Institutions positioned at this intersection will redefine their strategic edge, unlocking unparalleled growth in the next era of finance. For example, institutions can leverage bitcoin and other cryptocurrencies to facilitate cross-border payments, asset transfers, and new forms of digital asset management in the evolving financial landscape.

Explore how Relay can help your institution navigate cross-chain trading with maximum efficiency, security, and compliance. Embrace the future of finance today. As blockchain matures and institutional engagement intensifies, new paradigms like cross-chain exchanges and Internet Capital Markets (ICMs) are reshaping the financial landscape. For institutional investors and fintech professionals, understanding these innovations is critical to maintaining competitive advantage.

The Emergence of Internet Capital Markets

Internet Capital Markets represent a profound shift—traditional capital markets are merging with blockchain technology, enabling tokenization of diverse asset classes, from equities and bonds to real estate and commodities. These tokenized assets can now trade globally, seamlessly, and continuously, bridging geographical and regulatory divides.

This democratization provides institutions unprecedented access to liquidity, diversified asset classes, and innovative investment instruments, fostering a truly global market ecosystem.

Cross-Chain Exchanges: The Backbone of Decentralized Finance

At the heart of ICMs are cross-chain exchanges, sophisticated platforms enabling seamless and instant token trades across multiple blockchain networks. Unlike conventional exchanges limited by their infrastructure, cross-chain exchanges eliminate barriers, allowing institutions to move assets fluidly between blockchains like Ethereum, Solana, Avalanche, and Binance Smart Chain.

Platforms like Relay exemplify this by providing instantaneous transactions at significantly reduced costs—critical factors for institutional-scale trading and liquidity management.

Liquidity Pools and Market Efficiency

Liquidity pools are foundational to the efficiency and resilience of decentralized finance (DeFi) protocols. By aggregating crypto assets from multiple users, these pools provide the essential liquidity that powers decentralized exchanges (DEXs) and other DeFi platforms. This structure enables seamless peer-to-peer trading, allowing users to exchange tokens and other assets directly, without relying on traditional intermediaries.

Market makers and investors who contribute to liquidity pools are rewarded through interest rates, trading fees, and other incentives, making liquidity provision an attractive investment strategy. The introduction of bridge tokens and cross-chain bridges has further enhanced the utility of liquidity pools, enabling the transfer of assets and data across different blockchains and networks. This cross-chain capability opens up a wider range of opportunities, granting users access to new cryptocurrency markets and the ability to participate in diverse DeFi protocols.

Innovative mechanisms such as flash loans have emerged, allowing users to borrow assets from liquidity pools for short periods—often to capitalize on trading or arbitrage opportunities. While these features create dynamic and efficient markets, it is crucial for investors to recognize the risks involved. Crypto price volatility, smart contract vulnerabilities, and the complexities of blockchain technology can impact the security and value of funds within liquidity pools.

To navigate these challenges, investors should conduct thorough research into the protocols and platforms they engage with, understanding both the rewards and the risks. By staying informed and leveraging the transparency of blockchain data, users can make strategic decisions, optimize their participation in DeFi, and contribute to the ongoing evolution of Internet Capital Markets.

Strategic Advantages for Institutional Investors

Cross-chain exchanges and ICMs deliver strategic benefits:

- Enhanced Market Accessibility: Global, continuous trading across multiple asset classes and blockchain ecosystems.

- Cost Efficiency: Reduced transaction fees and operational costs via streamlined cross-chain protocols.

- Liquidity Optimization: Ability to quickly redeploy assets across chains to capture arbitrage opportunities and manage portfolio risks effectively.

Security and Compliance Considerations

For institutions, navigating this landscape requires stringent attention to security and regulatory compliance:

- Regulatory Clarity: Stay updated with global regulatory frameworks around tokenized assets to mitigate compliance risks.

- Custodial Security: Implement robust custody solutions—consider partnerships with regulated custodians specializing in digital assets.

- Operational Integrity: Prioritize cross-chain exchange platforms with transparent operations, comprehensive audits, and proven resilience against cyber threats.

The Future of Institutional Crypto Trading

Institutional participation in blockchain-driven markets signals the broader integration of decentralized technology into mainstream finance. Internet Capital Markets and cross-chain exchanges are not merely trends—they represent foundational shifts, presenting transformative opportunities for innovative institutions ready to embrace blockchain's full potential.

Institutions positioned at this intersection will redefine their strategic edge, unlocking unparalleled growth in the next era of finance.

Explore how Relay can help your institution navigate cross-chain trading with maximum efficiency, security, and compliance. Embrace the future of finance today.