How Relay Slashes Up to 70% Off Cross-Chain Swap Costs

Cross-chain swaps have a reputation for being slow and expensive, but Relay is changing the game. By using an intent-based architecture with a unified liquidity model, Relay enables some of the cheapest cross-chain swaps available – cutting swapping costs by up to 70% in gas fees and slippage. This beginner-friendly guide will explain how Relay works, why it’s so cost-efficient, and why it might be the best cross-chain bridge of 2025 for savvy crypto users.

How Relay Works – The Secret Behind the Cheapest Cross-Chain Swaps

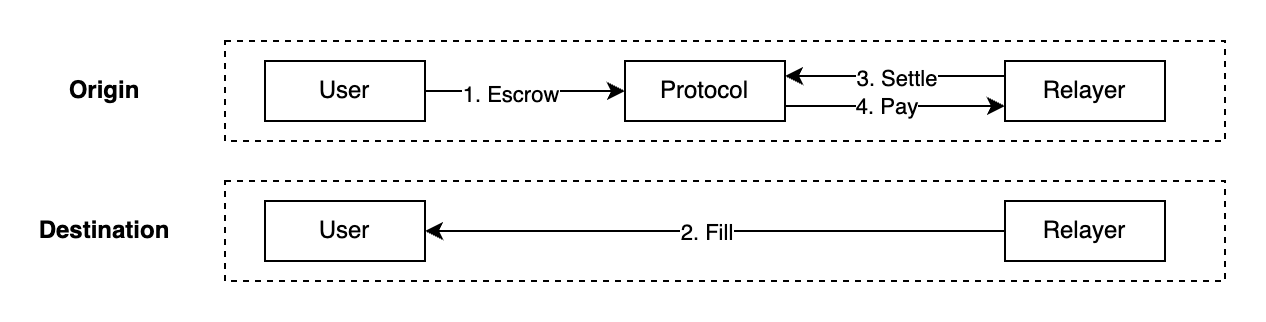

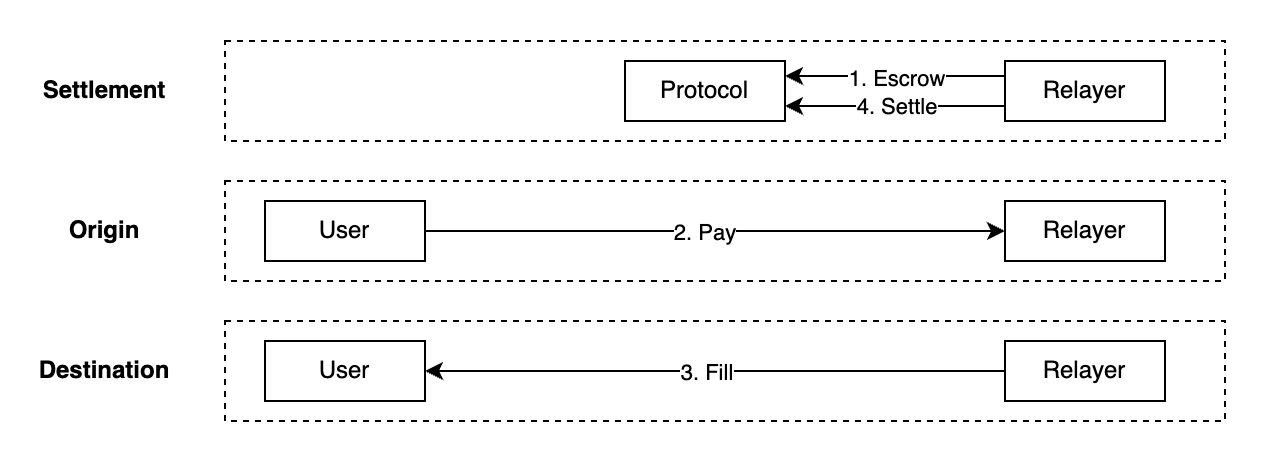

Relay Protocol is essentially a cross-chain transaction network that connects users with relayers – specialized agents that execute transactions on the user’s behalf across different blockchains. You can think of a relayer like a cross-chain courier: you give them assets on one chain, and they hand you the equivalent value on the destination chain, doing all the heavy lifting in between.

- Intent-Based Design: With Relay, you specify your intent (for example, “swap my Token A on Chain X for Token B on Chain Y”). The relayer then takes this intent and fulfills it directly, rather than you manually performing multiple steps. It’s like telling a travel agent you want to go to a destination, and they book the optimal route for you, instead of you buying each leg of the trip separately.

- Unified Liquidity Pool: Relay’s relayers maintain pools of liquidity across all supported chains, effectively creating a unified liquidity source. This means they have funds ready on each chain to swap for you, rather than relying on isolated pools on every individual network. By unifying liquidity, a relayer can tap into one big pot of assets that serves many chains, ensuring deep liquidity and minimizing price impact for your swaps.

- Simple User Experience: Using Relay feels like a normal swap, not a complex bridge. You initiate a swap and get a quote (exchange rate) from a relayer. If you accept, you send your assets to the relayer on the source chain, and almost immediately receive the target assets on the destination chain. The relayer later settles the funds behind the scenes (rebalancing their pools across chains as needed). For the user, it’s one smooth transaction – no manual bridging steps, no waiting around.

- Security via Relayer Bonds: You might wonder, “How can I trust the relayer?” Relay has a solution: relayers post bonds in escrow as a form of security. If a relayer failed to deliver your funds, that bond can be used to compensate you. In other words, the relayer has skin in the game, making it against their interest to cheat. This mechanism gives users protection even though a single relayer is handling the swap.

In summary, Relay works by letting a relayer instantly swap and transfer value for you across chains. It’s fast, because it skips the usual cross-chain waiting period, and it’s cheap, because it avoids redundant on-chain steps. As the Relay docs put it, “Relay is a cross-chain payments system that enables instant, low-cost bridging and cross-chain execution,” optimized to minimize gas costs and latency.

(Analogy): Imagine you have cash in one country and want cash in another. The traditional way would be to deposit money in Bank A, wait for a wire transfer or message to Bank B, then withdraw in local currency – incurring fees and delays at each step. Relay’s way is like having a trusted friend in the destination country front you the cash immediately as soon as you hand off your money at home. Later, your friend settles the balance with someone in your home country. You got your money almost instantly abroad, and you didn’t have to pay all those bank fees – that’s the power of Relay’s design.

Save Gas and Reduce Slippage on Crypto Swaps with Relay

One of the biggest selling points of Relay Protocol is how much it saves you on gas fees and slippage during cross-chain swaps. Traditional bridging and swapping can rack up costs from multiple transactions and price impact on each trade. Relay slashes these costs by doing things more efficiently:

- Minimal On-Chain Gas Usage: In a normal cross-chain swap, you might perform a token swap on Chain X (pay gas), send tokens through a bridge (pay gas and bridge fees), then swap again on Chain Y (pay gas again). Relay streamlines this. It executes the swap as a direct transfer between you and the relayer, instead of routing through multiple on-chain contracts. All the order validation and fee handling happens on a cheaper network (a low-cost settlement chain) rather than on expensive networks like Ethereum. This offloading dramatically cuts down gas usage on the primary chains. For example, a typical cross-chain bridge transfer using Relay consumes around 42,000 gas (combined across origin and destination), whereas even the next-cheapest alternative (Across) uses about 250,000 gas for the same operation. That’s roughly an 80% reduction in gas – imagine paying for just one small transaction instead of six! In practical terms, Relay can reduce the gas fees for a cross-chain swap by up to 70% or more, making it likely the cheapest cross-chain swap method you'll find.

- Less Slippage and Better Rates: Because Relay leverages unified liquidity and a relayer gives you a fixed quote, you avoid the heavy slippage costs that can come from using thin liquidity pools. In a traditional route, if you have to swap through multiple DEX pools on different chains, each step might have some price impact (slippage), especially for large trades. Relay’s model is more like an over-the-counter (OTC) trade or a one-stop swap – the relayer can internally source the liquidity to fulfill your request, so you get a fair rate that’s locked in by the quote. You won’t wake up to find that your transfer lost a chunk of value due to swapping through a bad exchange rate. In short, fewer hops = less slippage. By using one large liquidity source across chains, Relay keeps prices more stable for your swap. (For large transactions, this can save a significant amount that would otherwise be lost to price impact.)

- No Intermediate Tokens or Double Swaps: Relay often eliminates the need for intermediate stablecoins or “bridge tokens.” Many bridges force you to convert into a common token (like USDC or a wrapped asset) before moving chains, which introduces extra swap fees and slippage. Relay can take you directly from your source asset to the target asset in one go. Fewer conversions mean fewer fees and less chance for the price to slip.

To put it simply, Relay cuts out the fat in cross-chain swaps. It performs only the essential steps on expensive chains and moves everything else to cheap infrastructure. An intent-based approach like this “offers users meaningful savings and a better user experience” according to research on cross-chain designs. That’s why intent-based bridges (like Relay) are gaining traction – they are built to save you money while making the process easier.

(Analogy): Think of a multi-leg flight versus a direct flight. A multi-leg trip (like a typical cross-chain swap) has multiple takeoffs and landings – you pay airport fees and burn fuel each time (that’s like gas fees each step), and every connection risks delays (that’s like slippage or price changes). A direct flight (Relay’s approach) has one takeoff and one landing. You pay once and go straight to your destination, cutting out all the extra expense and hassle. By “doing the paperwork in a small town instead of the capital city,” as it were, Relay avoids high fees. The end result is you save on gas costs and get a stable exchange rate for your swap, maximizing the value that ends up in your wallet.

Why Relay Might Be the Best Cross-Chain Bridge of 2025

With its innovative design and user-focused benefits, Relay Protocol is emerging as a top contender for the best cross-chain bridge of 2025. Here are the key reasons why users should consider using it for their cross-chain swaps and transfers:

- Significant Cost Savings: Relay can slash swap costs by up to 70% by drastically reducing gas fees and minimizing slippage. This means you keep more of your money when moving assets across chains. Whether you’re bridging to chase a DeFi yield on another chain or buying an NFT on a different network, those savings add up. In crypto, every gwei counts – and Relay ensures you’re spending far less on fees.

- Faster Cross-Chain Transactions: Thanks to its intent-based relayer model, Relay completes most cross-chain swaps in a matter of seconds. There’s no more waiting for lengthy confirmations or wondering if your funds are stuck in limbo. The near-instant finality improves user experience dramatically. In 2025’s fast-paced crypto markets, speed is essential – and Relay delivers speed in spades.

- User-Friendly Experience: Relay abstracts away the complexity of bridging. You don’t need to juggle multiple tokens or perform several trades to get to your end asset. Just specify what you want on the target chain, and Relay handles the rest. This simplicity is welcoming to newcomers and saves seasoned users a lot of time and clicks. It’s like one-click shopping for cross-chain assets – a seamless experience that’s almost invisible in the background.

- Reduced Risk and No Wrapped Tokens Headache: Relay’s liquidity network approach uses real assets on the destination (not synthetic wraps), so you avoid the risks associated with wrapped tokens. You’re not exposed to a scenario where a bridge hack could invalidate a wrapped token, because Relay delivered the actual token you wanted. Additionally, the relayer’s bonded guarantee provides a layer of insurance for your transfer. And with the upcoming decentralization of relayers, the system’s security and resilience will only grow stronger. In summary, you get a quick, cheap swap without trading off security in any significant way.

- Growing Ecosystem and Multi-Chain Support: Relay is lightweight and easy to extend to new chains – essentially any chain where a relayer can run can be supported. This is critical as the crypto landscape in 2025 continues to expand with new Layer-1s and Layer-2 networks. Relay’s design doesn’t require massive new liquidity pools or complex contracts for each chain; adding support is relatively simple. This means as new opportunities arise on emerging chains, Relay can quickly be there to connect users, likely maintaining its edge as the cheapest and fastest option. Its architecture is built for the “any-to-any” chain future, making it a strong candidate for long-term dominance in cross-chain bridging.

Taking all these into account, Relay offers a compelling package for both technical and non-technical users who need to move assets across blockchains. It marries the convenience of a one-stop swap with serious cost savings that appeal to anyone watching their transaction costs. Given these advantages, it’s no stretch to say Relay is one of the best cross-chain bridge solutions in 2025 for those seeking speed, savings, and reliability in their crypto transactions.