How fomo Built Instant Crosschain Trading on Relay

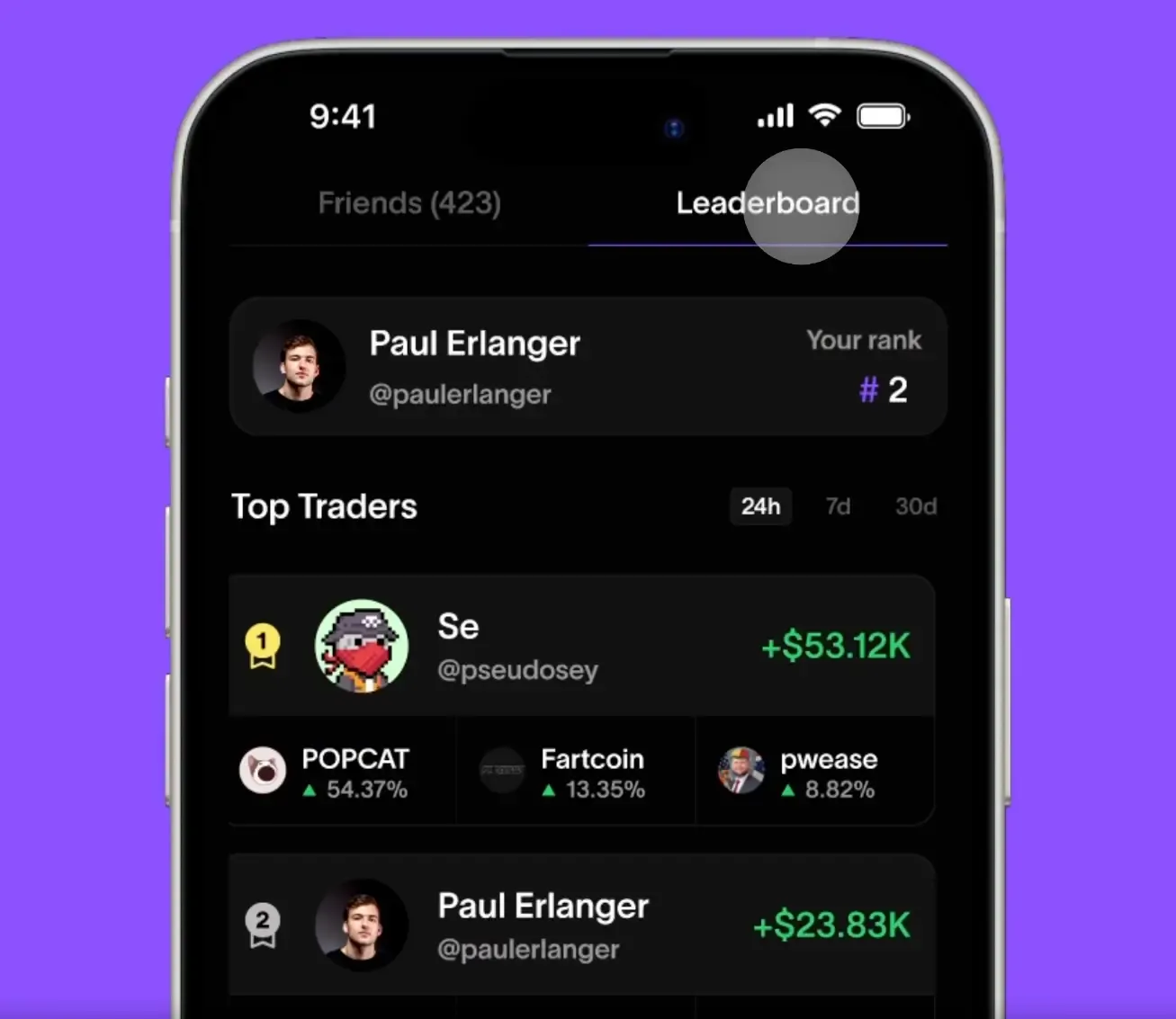

fomo set out to build a different kind of onchain trading experience - one where users don't think about chains or routes, and trading feels immediate. Open and close positions from a single spending balance, regardless of where liquidity lives. fomo is built for high-signal, realtime social trading. Prices move quickly, attention is fleeting, and trading has to keep up. At the core of the product is a simple idea: users trade in and out of one stablecoin balance. They don't choose chains or manage asset movement behind the scenes. They just trade. To make that experience work, the entire flow needed to be fully chain-abstracted - without compromising speed, cost, or reliability as markets move in real time.

The Constraints of Chain Abstracted Trading

Designing around a single spending balance across many chains creates real constraints. If crosschain execution is slow, prices can change before trades complete - breaking the trading experience. If it's expensive, users won't trade crosschain by default. And if execution doesn't work every time, trust in the abstraction disappears. For fomo, crosschain execution couldn't be a fallback. It had to be the default - fast enough for trading, cheap enough to use continuously, and reliable enough to stay invisible.

Why fomo Chose Relay

fomo integrated Relay to power instant crosschain execution.

Through Relay, fomo offers users a single USDC spending balance while the protocol coordinates routing, gas, and asset conversion behind the scenes. To users, trading feels like it's happening on one network, even though liquidity lives across many. Users maintain custody of their assets throughout - funds are held in onchain escrow until execution is verified.

fomo also uses Relay's fee sponsorship to cover destination chain fees on behalf of users. When a user buys an asset on a different chain, fomo sponsors all destination chain fees - including gas and any top-up amounts required to complete the transaction. Users only pay the origin chain gas to initiate the trade, with fomo covering the gas on Solana. Everything else is covered.

That shift - from visible infrastructure to invisible default - is what made the rest of the product possible.

Key outcomes:

- $317M in volume powered by Relay in 3 months

- Over 500,000 successful crosschain transactions in 3 months

- 92% of user activity happened across chains - without users needing to think about it

Once users could reliably trade into and out of the same stablecoin balance, crosschain activity became natural, not a conscious choice.

Proof in Practice: Monad

The launch of Monad showed the power of this approach. When Monad went live, fomo added support through Relay - and users were immediately able to trade Monad assets like any others on the platform. No new onboarding flow, no chain-specific UX, and no change in how users interacted with the app. As a result, 5–10% of Monad trading volume flowed through fomo, demonstrating what happens when crosschain trading is abstracted away and enabled by default.

Crosschain swaps are hard with complex failure modes - Relay makes it easy with their simple APIs, robust infra, and drive to deliver the best experience for the user - Prashan, Co-Founder, fomo

Ongoing Expansion

fomo continues to grow by expanding the assets and chains it supports - without changing the core user experience. As new chains and markets emerge, users can trade them using the same single spending balance, reinforcing the value of crosschain execution as the default rather than the exception. Through Relay, fomo can expand to new chains with predictable, reliable execution - allowing the team to focus on building the trading experience users actually care about.