Crypto Bridges 101: How to Transfer Assets Across Blockchains

The crypto ecosystem is expanding rapidly, with assets spread across numerous blockchains like Ethereum, Binance Smart Chain, Solana, and many more. However, these networks don’t inherently communicate with each other, making it challenging for users to move assets seamlessly. Enter crypto bridges—the essential tools connecting different blockchain worlds.

What Exactly is a DeFi Crypto Bridge?

A crypto bridge is a platform or protocol designed to transfer cryptocurrencies and tokens from one blockchain to another. Essentially, bridges create interoperability between separate blockchain networks, allowing users to move assets without relying on centralized exchanges. Bridges establish a connection between different blockchains, enabling users to access a wider range of ecosystems. By accessing alternative blockchains, such as Solana, users can benefit from improved transaction efficiency. Bridges facilitate transfers between different blockchains, making cross-chain activity seamless.

For instance, you can use a bridge to [move USDC from Ethereum to Solana](https://docs.relay.link/guides/solana) or Bitcoin onto Ethereum. When assets are bridged, new tokens are created on the destination chain to represent the original asset.

Role of Crypto Bridges in Decentralized Finance

Crypto bridges are a cornerstone of decentralized finance (DeFi), empowering users to move their crypto assets seamlessly between different blockchain networks. This interoperability means you’re no longer limited to the DeFi protocols and platforms available on a single chain. By bridging tokens across multiple blockchains, users can access a wider range of DeFi opportunities—whether it’s providing liquidity, trading, or lending. For example, you might bridge your assets from Ethereum to Solana to take advantage of lower transaction costs and faster speeds, unlocking new ways to earn rewards and participate in innovative DeFi projects. Ultimately, crypto bridges make it possible for users to maximize the utility of their assets, participate in a broader ecosystem, and benefit from the best features each network has to offer.

How Do Crypto Bridges Work?

Crypto bridges generally use one of two methods:

- Wrapped Tokens: A bridge locks your tokens on the original blockchain and issues equivalent wrapped tokens on the destination chain. For example, Wrapped Bitcoin (WBTC) on Ethereum is Bitcoin locked on the Bitcoin network, represented as a token on Ethereum. Bridge tokens are issued to facilitate cross-chain transfers, and some bridges allow users to receive native tokens on the destination blockchain, preserving the original asset's form and value.

- Liquidity Pools: Some bridges use decentralized liquidity pools to facilitate asset transfers, swapping tokens across chains via smart contracts and liquidity provided by users. During this process, token transfers are tracked and managed to ensure transparency and security throughout the bridging process.

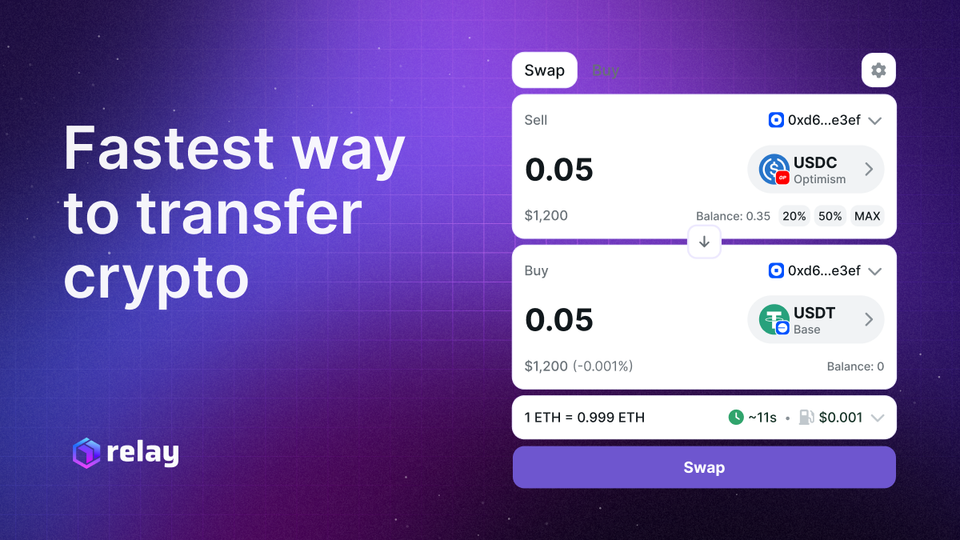

Platforms like Relay enhance this process by offering lightning-fast and cost-effective bridge transfers, using advanced cross-chain protocols. These bridges are powered by sophisticated software, ensuring secure and efficient token transfers across multiple blockchains.

Cross-Chain Transactions Explained

Cross-chain transactions are the process of transferring assets or data between different blockchain networks, made possible by crypto bridges. These bridges enable communication between multiple blockchains, allowing users to securely and efficiently move their assets across chains. This technology supports true peer-to-peer transactions, eliminating the need for traditional intermediaries like banks and enabling users to access and trade assets on different networks. By leveraging blockchain technology, cross-chain transactions maintain high levels of security and transparency, ensuring that data and value are transferred reliably. As a result, users can participate in a wider range of DeFi activities, trade across various platforms, and enjoy the benefits of a more interconnected cryptocurrency market.

Importance of Liquidity in Crypto Bridges

Liquidity is vital for the smooth operation of crypto bridges, as it ensures that assets can be transferred efficiently between different blockchain networks. Liquidity pools, often found on decentralized exchanges and DeFi platforms, provide the necessary funds to facilitate these cross-chain transactions. When users contribute assets to these pools, they help maintain the bridge’s functionality and stability, while also earning rewards for providing liquidity. This not only supports active trading and investment but also reduces the risks involved in cross-chain transfers by ensuring there are always enough funds to complete transactions. For investors and users, participating in liquidity pools is a way to contribute to the growth of the DeFi ecosystem while benefiting from potential returns.

Why Use Crypto Bridges?

Crypto bridges provide several critical benefits:

- Asset Flexibility: Use your assets freely across multiple blockchain networks.

- Enhanced Liquidity: Access deeper liquidity pools and opportunities available on other chains.

- Lower Costs: Bridges can reduce transaction fees compared to traditional exchanges.

- Speed: Some platforms, like Relay.link, offer near-instant transfers across blockchains.

Anyone with an internet connection can use crypto bridges to participate in DeFi activities across multiple blockchains.

Considerations and Risks

While crypto bridges are incredibly useful, there are a few things to keep in mind:

- Security: Ensure you’re using reputable bridges, as they manage significant value, making them potential targets for exploits.

- Costs: Although generally lower, costs can vary significantly depending on the blockchain networks involved.

- Compatibility: Not all bridges support all assets or chains, so always verify supported tokens.

- Lending and Borrowing Risks: If you use bridges to lend assets or access DeFi lending protocols, be aware of the risks involved. Interest rates can be highly variable, and loan terms may change quickly. While you can earn interest by lending your crypto, the decentralized nature of these platforms means you should carefully review the terms and understand the potential risks before participating.

Regulatory Environment for Crypto Bridges

The regulatory landscape for crypto bridges is still taking shape, with different countries and regions adopting varying approaches to oversight. As DeFi protocols and platforms become more popular, regulators are paying closer attention to the risks involved in cross-chain transactions. However, the decentralized nature of these technologies presents unique challenges, as traditional regulatory frameworks may not easily apply. Clear and comprehensive regulations can help eliminate risks and protect users, while still allowing for the innovation and growth that make decentralized finance so appealing. As the industry evolves, finding the right balance between security and freedom will be key to fostering a safe and thriving environment for all participants.

Applications and Implications of Crypto Bridges

The potential applications of crypto bridges extend far beyond simple asset transfers. By enabling the movement of assets and data between different blockchain networks, bridges open the door to a wide range of decentralized finance activities. For instance, users can take advantage of flash loans—borrowing assets for a short period to capitalize on market opportunities—across multiple chains. Crypto bridges also make it easier to provide liquidity, invest in new cryptocurrency projects, and access a wider range of tokens and DeFi protocols. As more users and investors participate in these cross-chain transactions, the cryptocurrency market becomes more dynamic and interconnected, driving innovation and expanding the possibilities for decentralized finance.

Steps to Use a Crypto Bridge

Here’s a quick step-by-step guide. Unlike traditional cryptocurrency exchanges, using a bridge allows you to move assets directly between blockchains without relying on centralized platforms, offering a different approach to asset transfer.

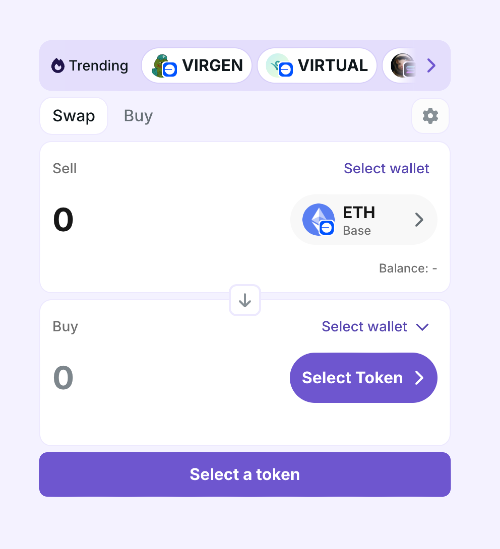

- Select a Reliable Bridge: Choose a secure, reputable service such as Relay.

- Connect Your Wallet: Typically, you’ll connect your wallet to both blockchains. Your wallet will communicate directly with the blockchain to authorize the transfer.

- Choose Assets and Networks: Select the asset and source/destination blockchains. You can exchange assets across blockchains using the bridge.

- Execute the Transfer: Confirm the transaction details and initiate the transfer.

- Confirm Receipt: Check your wallet on the destination blockchain.

Conclusion

Crypto bridges are essential tools for anyone navigating multiple blockchain ecosystems. By understanding and utilizing them, you can greatly enhance your flexibility, access, and efficiency in crypto trading and investing. Bridges not only enable the transfer of assets, but also the movement of values across blockchains, supporting a more interconnected crypto landscape. Keep in mind that crypto prices can fluctuate significantly, impacting the benefits of using bridges and participating in DeFi. Leveraging these technologies can help you manage and grow your money, shaping your financial future in the evolving world of digital assets.

Ready for seamless cross-chain transfers? Try Relay —the fastest, easiest, and most affordable way to bridge your crypto assets today!