Cheapest Way to Swap Crypto: 5 Tips to Minimize Fees

Crypto traders know that even small transaction fees can add up fast, especially when swapping assets frequently. Whether you're a seasoned investor or just getting started, reducing costs can significantly improve your trading outcomes. Here's an SEO-focused guide with 5 actionable tips to help you swap crypto at the lowest possible cost.

Use DEX Aggregators to Get the Best Rates When You Swap Crypto

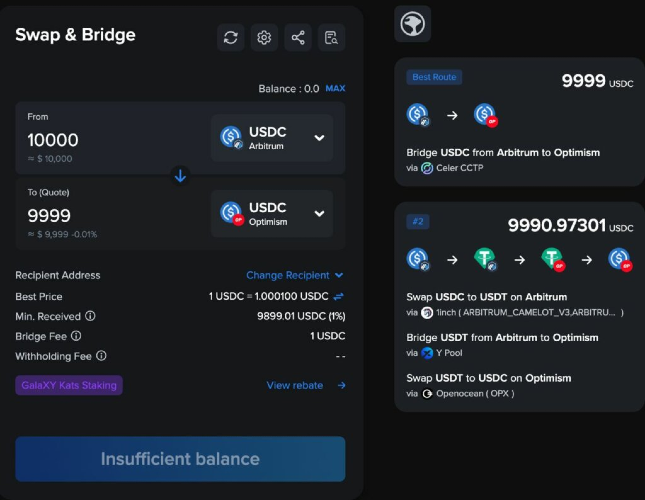

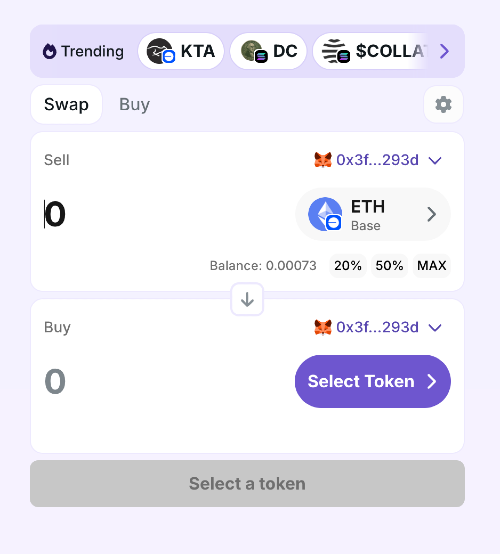

Decentralized Exchange (DEX) aggregators scan multiple liquidity sources to find the best price for your trade. This process, known as a crypto swap, allows users to seamlessly exchange cryptocurrencies across different platforms. Instead of relying on a single DEX, these platforms route your order through the most efficient path, often saving you money in the process.

Top DEX aggregators include:

Aggregators compare exchange rates and prices across various sources to ensure you get the best value for your trade. By using an aggregator, you avoid overpaying due to low liquidity or poor price execution on a single platform, and you can find the best deals for your swaps.

2. Choose Low-Fee Networks

Not all blockchains are created equal when it comes to transaction fees. Ethereum is known for its high gas costs, especially during peak times. In contrast, newer chains like:

…offer significantly lower fees for similar functionality. Swapping on these chains can drastically reduce your costs—sometimes saving you several dollars per transaction compared to high-fee networks.

3. Time Your Transactions Wisely

Blockchain congestion varies by the hour and day. Avoid swapping during periods of high network activity—typically weekday afternoons (UTC)—when gas fees spike.

Pro tip: Use tools like Eth Gas Station or TxStreet to monitor congestion and time your swaps for off-peak periods. By timing your swaps carefully, you can save on transaction fees.

4. Avoid Double Swaps or Multiple Steps

Sometimes users perform two or more swaps to get from Token A to Token C (e.g., A → B → C), whether swapping tokens or coins. This racks up fees with each hop. Instead, use platforms that support direct swaps or route your transaction efficiently.

This is where Relay.link shines, offering deep linking:

- Direct cross-chain swaps between 70+ blockchains, allowing you to convert assets seamlessly between networks

- Smart routing through optimal paths

- Minimal slippage and fewer steps

5. Use Relay.link for Cross-Chain Swaps

Relay.link is built for speed and affordability, reducing cross-chain swap fees by up to 70% compared to traditional methods. Relay.link provides easy access to cross-chain swaps, allowing users to seamlessly connect and exchange assets across major networks. Here’s why it’s ideal for cost-conscious traders:

- One-click swaps across major networks

- No bridging, wrapping, or intermediary steps

- Flat-rate pricing with low fees and fast execution

A key benefit for cost-conscious traders is the significant savings on fees and the efficient execution of swaps. Additionally, users can earn cashback rewards on every swap, making Relay.link even more attractive for frequent traders.

7. Security Considerations for Cross-Chain Swaps

As cross-chain swaps become more popular, security should be at the forefront of every crypto user’s mind. Moving assets between different blockchain networks introduces unique risks that aren’t present in single-chain transactions, making it essential to choose a crypto exchange that puts security first.

One of the best ways to protect your funds is by using a non-custodial wallet. With a non-custodial wallet, you retain full control over your private keys and crypto assets, reducing the risk of loss from exchange hacks or mismanagement. When selecting a platform for your cross-chain swaps, look for exchanges that support non-custodial wallets and have a proven track record of safeguarding user funds.

Security features like multi-signature wallets, cold storage, and regular third-party security audits are also crucial. These measures help protect your assets and ensure that the exchange is committed to maintaining a secure environment for all transactions. Always verify that the crypto exchange you use has transparent security practices and a reliable deposit address system to prevent errors or fraud.

Cross chain interoperability is another key factor. Secure cross-chain swap protocols, such as atomic swaps, allow users to swap assets directly between different blockchain networks without relying on a central authority. Atomic swaps are designed to be trustless and decentralized, ensuring that both parties receive their tokens only when all conditions are met. This reduces the risk of failed transactions or lost funds during the swapping process.

Network fees and transaction processing times can also impact the security and efficiency of your swaps. High network fees can eat into your profits, while slow transaction times may expose you to price volatility and market risk. To minimize these risks, choose exchanges that offer low fees, fast execution, and up-to-date information on swap pairs, exchange rates, and cross chain liquidity.

Bridges play a vital role in enabling cross chain swaps, but they can also introduce vulnerabilities, such as smart contract bugs or liquidity fragmentation across different networks. It’s important to use exchanges that have a strong history of secure bridge implementation and ongoing maintenance, ensuring your assets are protected throughout the transaction.

Ultimately, the security of your cross-chain swaps depends on a combination of the exchange’s safeguards, your own vigilance, and the overall market environment. By choosing reputable crypto exchanges, using non-custodial wallets, and staying informed about the process, you can unlock the full benefits of cross-chain swaps—accessing the best crypto exchange rates, low fees, and a world of new trading opportunities—while keeping your assets secure.

Final Thoughts

High transaction costs can quietly eat into your crypto profits—but they don’t have to. You can conveniently swap crypto on mobile devices, making it easier to manage your assets on the go. By applying the strategies above and leveraging tools like Relay.link, you can minimize swap fees and keep more of your crypto where it belongs: in your wallet.

Ready to make your next swap the cheapest one yet? Create an account to get started with Relay.link and unlock ultra-low-fee, cross-chain crypto swaps.