Bridging DeFi Gaps: How Cross-Chain Bridges Unlock New Markets

The decentralized finance (DeFi) landscape has exploded with innovation, but its growth has been hampered by one major challenge: fragmentation. Each blockchain ecosystem often operates in isolation, limiting the accessibility and utility of assets locked within them. Cross-chain bridges are changing that, creating interoperability across networks and opening the door to new markets, liquidity, and investment opportunities.

The Problem of Fragmentation in DeFi

DeFi protocols traditionally launch on specific blockchains—Ethereum, BNB Chain, Avalanche, etc. Bitcoin, as the first major cryptocurrency, played a pivotal role in shaping the development of DeFi and the broader cryptocurrency ecosystem. While these platforms offer distinct advantages, assets native to one chain are typically inaccessible to users on others. New tokens and assets are created on different blockchains, which contributes to fragmentation. This fragmentation can be compared to traditional banks, where financial services like loans, savings accounts, and earning interest are provided by centralized institutions, but DeFi aims to offer these same services without the need for banks.

The inefficiencies of this system include increased costs when moving money between blockchains, as users often face additional fees and hurdles. This creates silos, trapping value and preventing money from flowing freely across the broader crypto economy.

How Cross-Chain Bridges Solve It

Cross-chain bridges serve as connective tissue between blockchains, enabling users to move assets seamlessly from one network to another by establishing a secure connection that facilitates interoperability. When an asset is transferred between blockchains, the bridge typically locks the asset on the source chain and mints a corresponding token on the destination chain, or burns and unlocks as needed, ensuring the asset's value is preserved and securely moved.

Bridges also enable communication and the transfer of data between blockchains, allowing DeFi applications to interact and exchange information across networks. Unlike traditional exchanges, bridges offer greater efficiency and cost savings by allowing direct cross-chain transfers without relying on centralized platforms. Anyone with an internet connection can participate in DeFi and cross-chain activities, making these technologies accessible globally. Choosing a secure platform and reliable software is essential for safe bridging and DeFi operations.

By doing so, they unlock the full potential of DeFi by:

- Making Assets Interoperable: You can now use ETH on Avalanche, or transfer USDC from Polygon to Arbitrum, with tokens securely transferred to the destination chain.

- Unlocking Liquidity: Previously siloed tokens can now participate in yield farming, lending, and trading on other chains, transferring values and opening new investment opportunities.

- Enhancing Capital Efficiency: Investors can move assets to where opportunities are best without centralized intermediaries. DeFi enables peer-to-peer lending, allowing users to lend and take out loans directly, earn interest, and benefit from variable interest rates.

Real-World Examples

As an example of cross-chain DeFi in action, consider a DeFi project on Ethereum that tokenizes real estate. Without bridges, only Ethereum users can invest. But with cross-chain bridging, investors from Solana, BNB Chain, or Optimism can participate by moving stablecoins across chains. Unlike traditional cryptocurrency exchanges, which facilitate fund transfers within their own platforms, bridges enable direct movement of assets between different blockchains. This dramatically expands the investor base and deepens liquidity.

Crypto prices can significantly influence investor participation in cross-chain DeFi projects, as periods of high volatility or market downturns may affect willingness to move funds across chains. This is where Internet Capital Markets take shape—projects on any chain can access global capital flows, making DeFi truly borderless and shaping the future of global finance and investment.

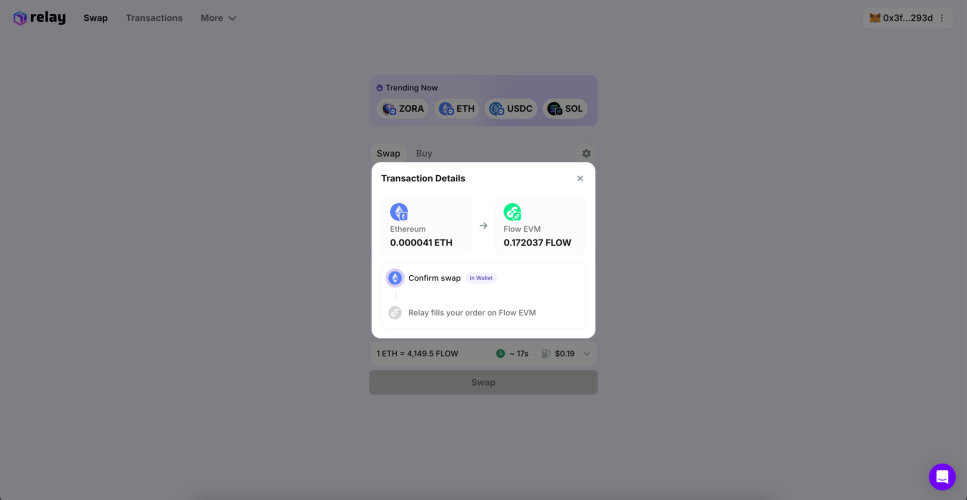

Relay.link: Powering Cross-Chain Liquidity

Relay.link plays a pivotal role in this new era by connecting over 72 blockchain networks. Through its high-speed, low-cost bridging infrastructure, Relay:

- Enables near-instant transfers across major chains

- Supports token swaps and bridging in a single, unified interface, including seamless integration with decentralized exchanges to enhance cross-chain liquidity

- Reduces fees significantly compared to traditional methods

Relay is powered by advanced software that ensures secure, efficient, and scalable bridging and liquidity solutions. The platform also navigates the evolving landscape of regulation in DeFi, helping users operate in an environment where oversight is limited and compliance challenges persist.

By removing the friction from cross-chain transactions, Relay empowers users and developers to unlock new DeFi markets and build applications with true global reach.

Challenges and Limitations

While decentralized finance and cross-chain bridges have opened up a world of possibilities for crypto assets and blockchain technology, they also come with a unique set of challenges that users, developers, and financial institutions must navigate.

Security remains a top concern. DeFi protocols and cross-chain bridges are frequent targets for cyberattacks, given the vast amounts of value they manage. For instance, vulnerabilities in bridge tokens or liquidity pools can be exploited through sophisticated attacks, such as flash loans, resulting in significant losses. The decentralized nature of these platforms means that, unlike traditional banks, there is often no recourse for users if funds are lost due to a breach. This makes robust security protocols, regular smart contract audits, and transparent processes essential for building trust in the ecosystem.

Scalability is another pressing issue. As more users participate in DeFi platforms and cross-chain transactions, network congestion can lead to higher transaction fees and slower processing times. This can limit access, especially during periods of high market activity, and may deter new users from engaging with decentralized apps or providing liquidity across different blockchains. Ensuring that DeFi protocols and bridges can handle increased demand without sacrificing speed or affordability is crucial for mainstream adoption.

Regulatory uncertainty adds another layer of complexity. Because DeFi and cross-chain bridges operate outside traditional financial frameworks, they often lack clear regulatory guidance. This can create confusion for users and challenges for financial institutions looking to participate or invest. The absence of standardized regulations can also make it difficult to ensure transparency and protect users from potential risks involved in cross-chain transactions and token transfers.

User experience and complexity can be barriers to entry. Bridging assets between different networks often requires multiple steps and a deep understanding of how various protocols interact. Mistakes in the process can lead to lost funds or failed transactions, making it intimidating for newcomers. As the ecosystem grows, simplifying the process of accessing and transferring assets across chains will be key to attracting a wider range of users.

To address these challenges, the industry is investing in advanced security measures, such as multi-signature wallets and continuous smart contract monitoring. Collaboration between DeFi platforms, developers, and regulators is also underway to create clearer standards and improve communication between different blockchains. By focusing on security, scalability, and user-friendly design, the DeFi community aims to eliminate barriers and unlock the full potential of cross-chain bridges—enabling seamless, secure, and transparent access to a global cryptocurrency market.

Overcoming these hurdles will not only protect users and their investments but also pave the way for a more resilient and inclusive financial system, where anyone can participate, trade, and earn rewards across multiple blockchains with confidence.

Conclusion

Cross-chain bridges are the key to DeFi’s next growth phase. They break down barriers, free capital from isolated ecosystems, and enable the rise of Internet Capital Markets. Platforms like Relay make this possible by offering seamless, reliable, and cost-efficient bridging that opens up access to a truly global audience.

Want to move assets across 80+ chains with one click? Discover how Relay is bridging DeFi's biggest gaps—instantly.