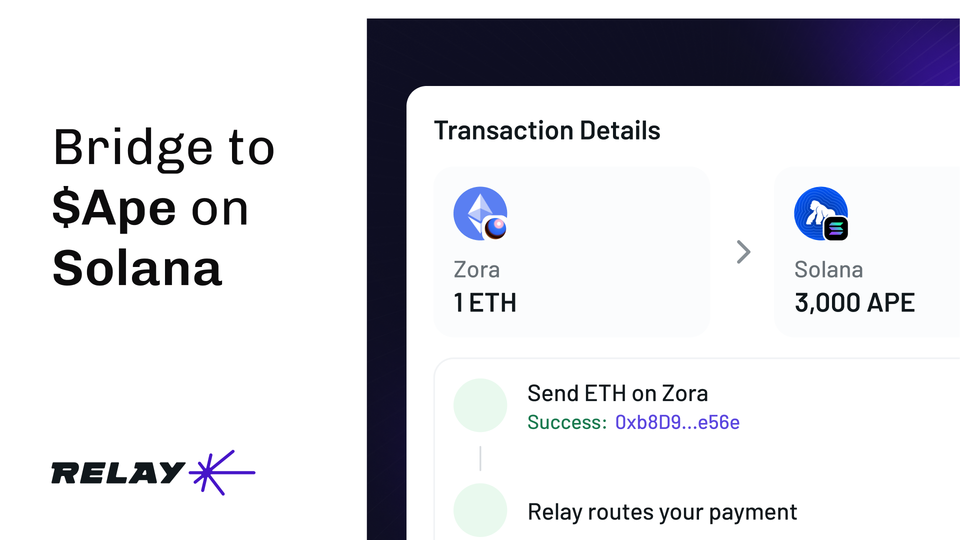

How to Bridge to Ape on Solana Using Relay

The explosive growth of Solana’s ecosystem has created unprecedented opportunities for crypto investors looking to “ape” into high-yield DeFi protocols, trending memecoins, and emerging projects. ApeCoin, an ERC-20 governance and utility token within the APE ecosystem, plays a key role in decentralized applications and is integrated with blockchain technology.

Bridging assets to Solana has surged 114% in 2025, with over $10.1 billion in inbound volume as traders seek access to the network’s sub-penny fees, 65,000 TPS throughput, and vibrant ecosystem. The Bored Ape Yacht Club, a significant NFT collection created by Yuga Labs, has greatly influenced the development of the APE ecosystem and the relevance of bridging assets to participate in related projects such as Otherside and other Web3 initiatives.

Why Relay offers superior Solana bridging

Relay revolutionizes crosschain bridging through its intent-based architecture that connects users directly with relayers who fulfill transactions using pre-positioned capital, eliminating traditional bridge bottlenecks.

As a powerful tool for users and developers, Relay enables efficient bridging of assets across chains, supporting seamless integration and development within the ecosystem. This innovative approach achieves 1-10 second transaction completion times at up to 80% lower costs than competing solutions.

Relay's technical advantages for Solana users

Relay’s ultra-fast settlement directly addresses the time-sensitive nature of aping opportunities on Solana. While traditional bridges require 5-20 minutes for completion, Relay’s optimistic execution model delivers assets within seconds, crucial when competing for entry into trending tokens or time-sensitive DeFi strategies. Relay has processed over $6 billion in volume across 59+ million transactions, demonstrating proven reliability.

Step-by-step guide to bridge to Solana using Relay

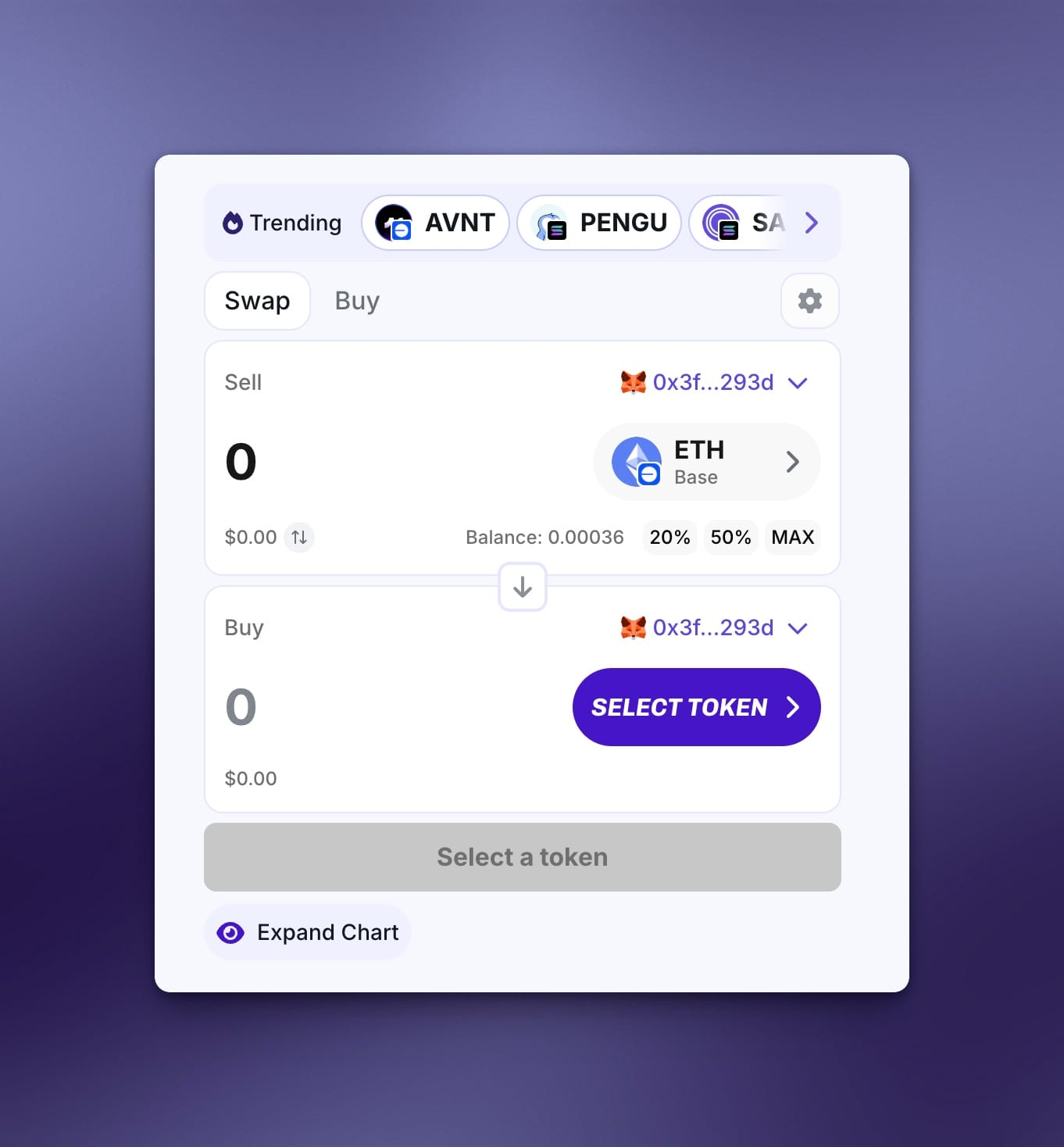

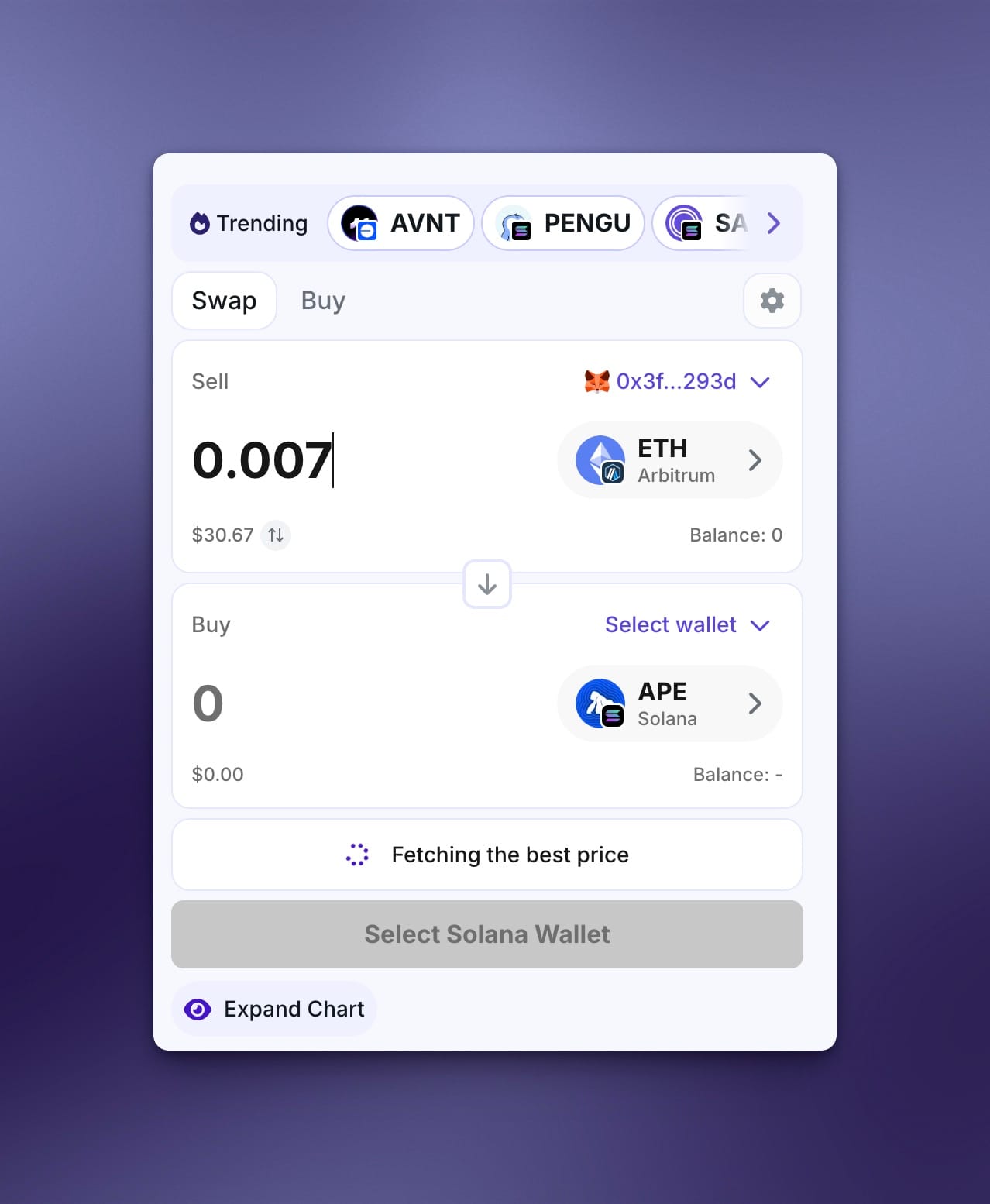

Navigate to Relay’s official bridge interface at relay.link and connect your source chain wallet (MetaMask, WalletConnect, or other supported wallets). Before accessing the bridge interface, ensure your internet connection is secure. Verify the URL authenticity to avoid phishing sites that target bridge users. You may be required to complete a human verification step before proceeding with the transaction.

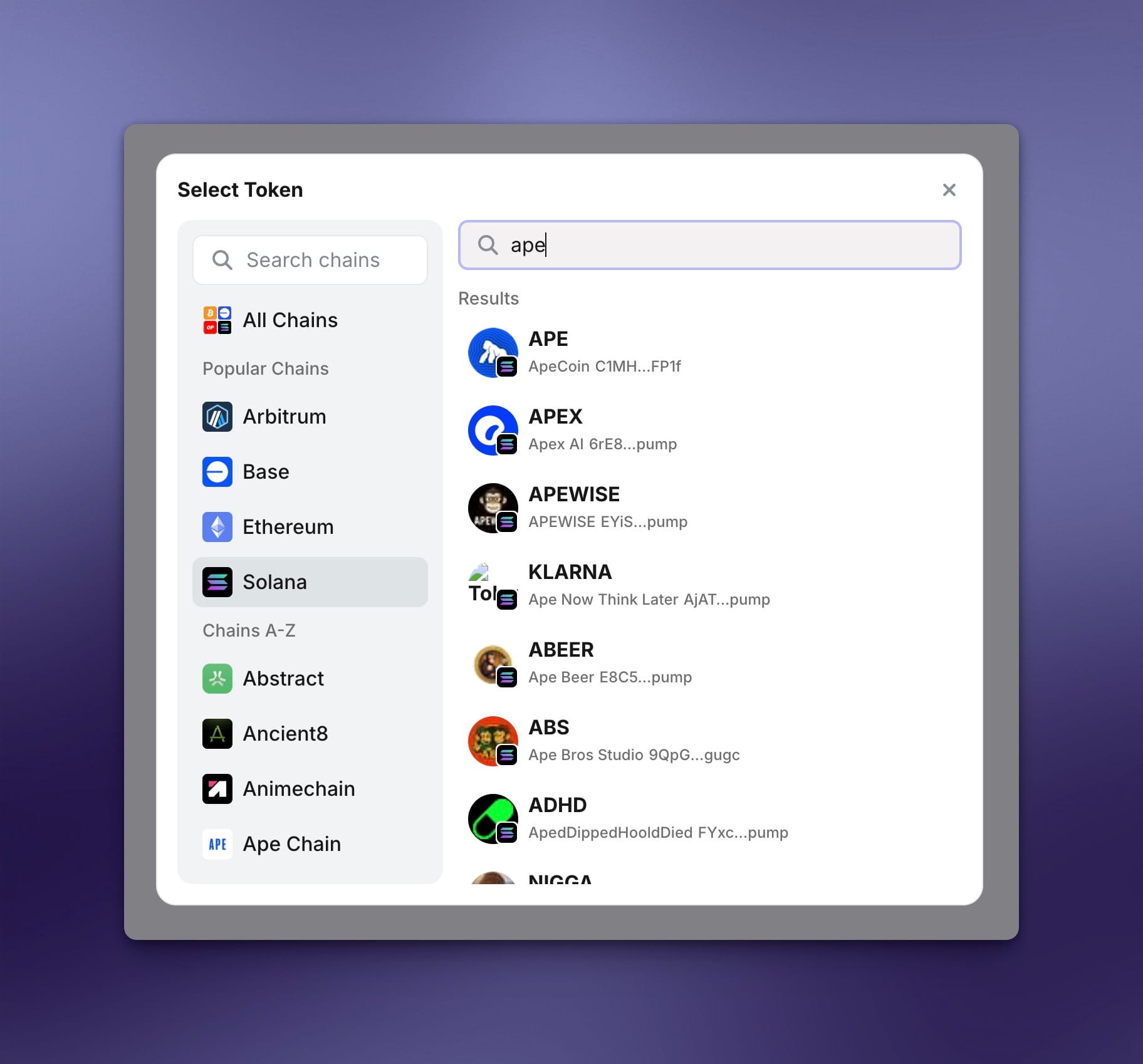

Configure your bridging transaction by selecting your source chain and token, choosing Solana as the destination, and entering your Solana wallet address. Solana addresses are case-sensitive, so double-check accuracy to prevent fund loss. Specify the amount to bridge, ensuring you maintain sufficient native tokens for transaction fees.

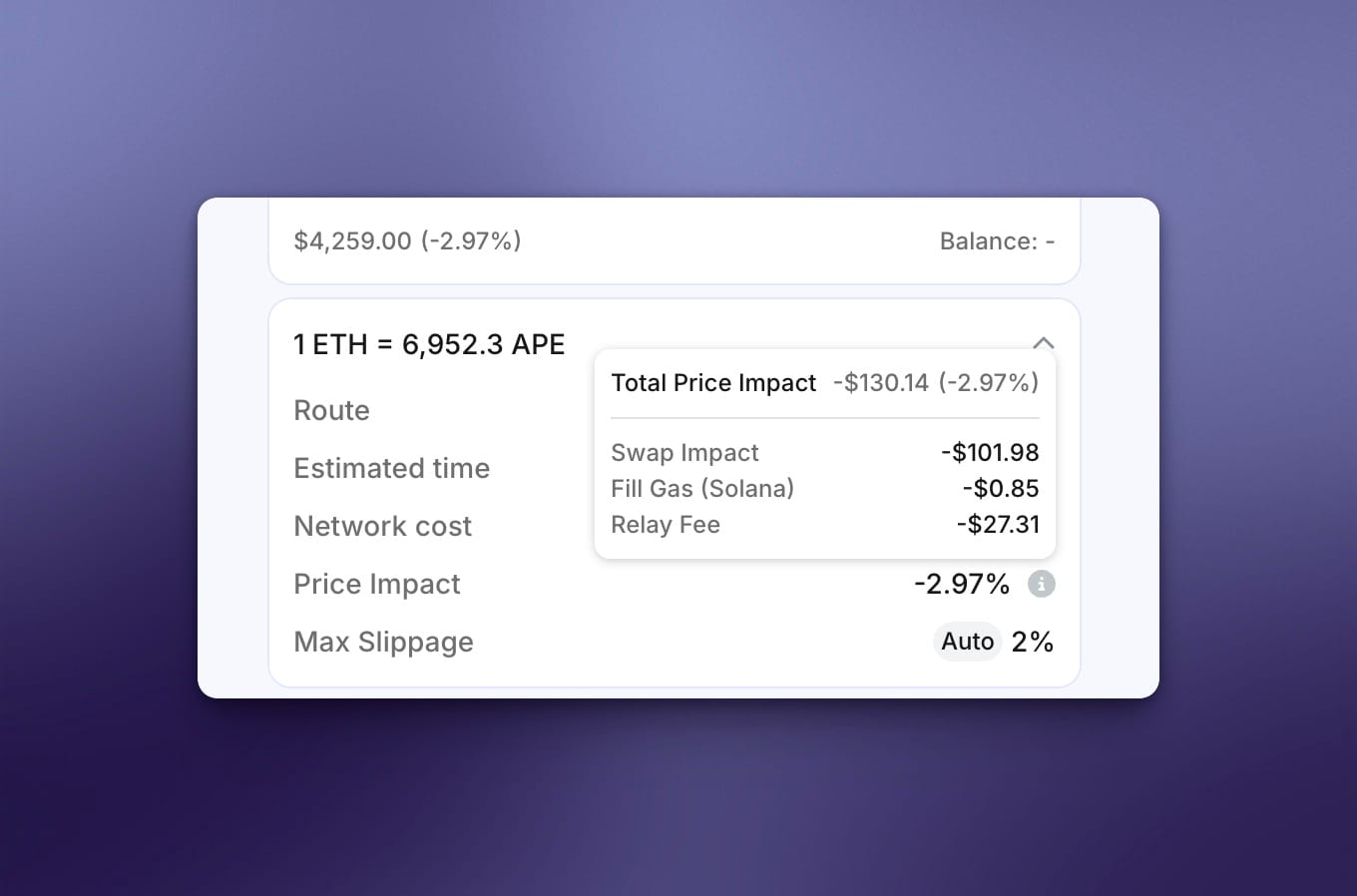

Review and execute the transaction by examining the quote details including fees, exchange rates, and estimated completion time. Relay typically provides instant quotes with no slippage. Approve the transaction in your wallet and monitor progress through the interface. Most transactions complete within 10 seconds.

Cost analysis and fee optimization

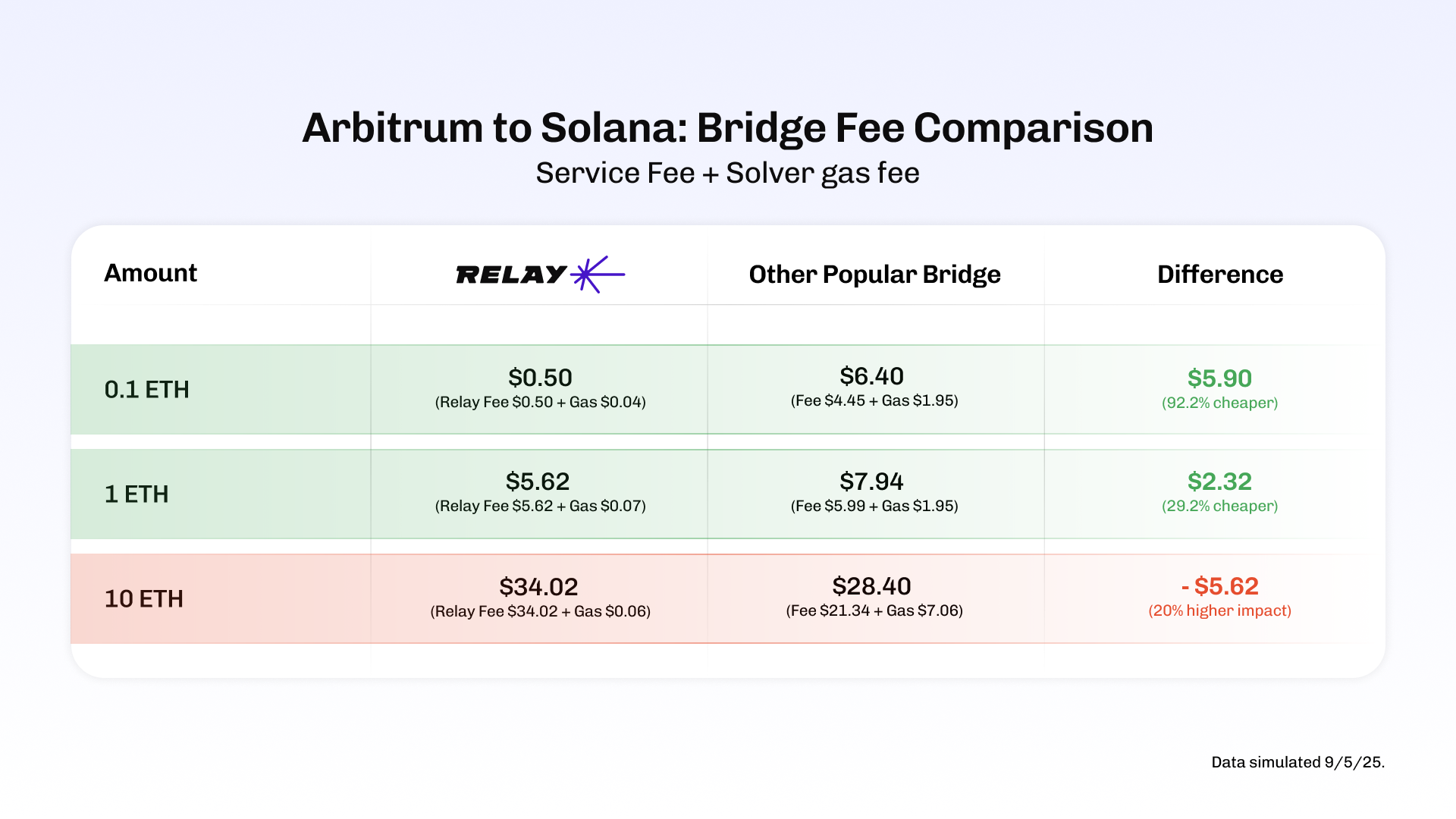

Understanding Relay’s fee structure helps optimize bridging costs for different transaction sizes. The protocol uses competitive pricing that typically beats traditional bridges by 30-80%, particularly for speed-sensitive transactions where time value exceeds small fee differences. Relay’s rapid settlement times also minimize user waiting, ensuring transactions are completed much faster than with traditional bridges.

Relay fee structure compared to alternatives

Relay’s intent-based model eliminates many traditional bridge fees including liquidity provider fees, slippage costs, and wrapped token premiums. Users pay direct relayer fees plus standard network gas costs, resulting in predictable, transparent pricing.

Relay’s governance model allows users to participate in key protocol decisions, such as changes to fee structures, by casting a vote within the ecosystem.

Comparative analysis shows significant advantages over traditional bridges. Wormhole charges 0.04% with a maximum of 1,000 USDC, making large transfers expensive. Allbridge imposes 0.3% fees plus yield-sharing requirements. DeBridge uses flat 0.001 ETH fees (~$3.50) that become cost-prohibitive for small transfers. Relay’s competitive pricing often delivers the best rates across transaction sizes.

For cost optimization, consider transaction timing during network off-peak hours, batch multiple transfers when possible, and monitor gas prices on origin chains. Layer 2 origins like Arbitrum or Base typically cost $1-2 versus $5-30 for Ethereum mainnet transactions.

Troubleshooting common bridging issues

Transaction failures can occur due to network congestion, insufficient gas fees, or temporary protocol issues. Most problems resolve through patience and proper diagnostic procedures rather than panic reactions that cause additional losses. The customer support team is responsible for handling user issues and ensuring successful resolution.

Diagnosing failed transactions

Check transaction status

Check transaction status using block explorers for both origin and destination chains. Relay provides built-in transaction tracking, but independent verification helps identify specific failure points. Look for transaction hashes, confirmation counts, and gas usage patterns.

Verify network conditions

Verify network conditions including gas prices, network congestion levels, and any ongoing maintenance or upgrade activities. Solana's 99.99% uptime in 2025 minimizes network-related failures, but origin chain congestion frequently causes delays or failures.

Contact protocol support

Contact protocol support through official channels if transactions remain pending beyond expected timeframes. Most reputable bridges provide responsive customer support and automated refund mechanisms for legitimate failures.

Recovery procedures

Failed transactions typically auto-refund

Failed transactions typically auto-refund within 24-48 hours through protocol-level mechanisms. Relay's automated refund system handles most failure scenarios without user intervention, though complex failures may require manual resolution.

Document all transaction details

Document all transaction details including hashes, timestamps, amounts, and error messages for support inquiries. Screenshot transaction interfaces and maintain records for potential insurance claims or legal action.

Conclusion

Bridging to Solana using Relay provides the optimal combination of speed, cost-efficiency, and security for accessing the network’s explosive growth opportunities. The protocol’s innovative intent-based architecture delivers 1-10 second settlement times at up to 80% cost savings compared to traditional solutions, crucial advantages for time-sensitive aping strategies in Solana’s fast-moving ecosystem. Solana has block times of 400 milliseconds, further enhancing its appeal for high-speed transactions.